end of header

International Trade

You are here: Census.gov › Business & Industry › International Trade › Regulations

FTR Letter No. 9

| MEMORANDUM FOR | U.S. Customs and Border Protection Headquarters, Port Directors, U.S. Principal Parties in Interest, Freight Forwarders, and Authorized Agents of Pipeline Shipments, Pipeline Operators, and All Others Concerned |

| From: | U.S. Census Bureau and U.S. Customs Border and Protection |

| Subject: | Reporting Conventions for Exports of Natural Gas via Pipeline |

This memorandum serves to notify the trade community regarding finalized reporting conventions for exports of natural gas via pipeline. These conventions were a collaborative effort between the U.S. Census Bureau, U.S. Customs and Border Protection, and the Pipeline Industry. They were developed to address some common reporting concerns regarding pipeline shipments of natural gas.

We expect all U.S. Principal Parties in Interest or Authorized Agents to come into compliance with the Foreign Trade Regulations (FTR) and fully report all electronic export information for natural gas exports via pipeline in the Automated Export System. FTR Section 30.46 states that the pipeline operator must deliver the proof of filing citation, exemption, or exclusion legends to the CBP Port Director within four calendar days following the end of the month. Please refer to FTR Subpart H, Sections 30.70 through 30.74, for the penalty and enforcement procedures.

We thank you for your efforts to comply with the FTR. If you need additional assistance or have further questions, please contact the Census Bureau’s, Foreign Trade Division, Regulations, Outreach, and Education Branch on 800-549-0595, option 3.

Please see below conventions.

Reporting Conventions for Exports of Natural Gas via Pipeline

Each of the items listed shall be reported in the Automated Export System (AES) as detailed below for pipeline exports of natural gas.

- State of Origin:

The State where the Natural Gas leaves the United States.

- Port of Export:

The nearest U.S. Customs and Border Protection port to the actual border crossing location that is valid for a fixed mode of transportation. “Fixed” refers to fixed transport installations such as pipelines. The list of “Fixed” ports can be found in the AES Trade Interface Requirements (AESTIR) Appendix D (http://www.cbp.gov/document/guidance/appendix-d-export-port-codes-0).

- Departure Date:

The following 2 options may be used to report the Date of Export:

1). Shipments may be filed throughout the month. The date of export should be reported as the actual date of export.

OR

2). Shipments made throughout a given month may be consolidated and reported as one shipment within four calendars days of the end of the month.* The date of export shall be reported as the last calendar date of that month.* Note, consolidated shipments must be shipped from the same USPPI to the same Ultimate Consignee (as defined below) within the same departure month and through the same pipeline.

- Foreign Trade Zone (FTZ):

Shipments leaving from a FTZ will be reported the same as all other shipments, however if the goods leave from a FTZ, the USPPI or their authorized agent must report the FTZ in the AES. Shipments originating from various FTZs will need to be filed as separate shipments.

- Ultimate Consignee: Company Information and Address

The person, party, or designee that is located in Canada and actually receives the export shipment. This party may be the end user or the Foreign Principal Party in Interest (FPPI). If the Ultimate Consignee is not known, the name and address of the Hub in Canada closest to the border crossing may be reported.

- 1st Unit of Quantity:

Per the Schedule B, the required unit of quantity for natural gas should be reported in cubic meters. The industry has proposed using 1 Dth x 0.02832784 = 1 KM^3 as the conversion rate. The Census Bureau accepts this proposed formula with the understanding that:

(1) further conversion must be done for the required unit to be reported (cubic meters); and

(2) as the market changes, these figures may change and the industry is expected to report the most up to date and accurate information at the time of filing. - Value:

The “value” may be reported using either of the following methods:

Foreign Trade Regulations (FTR) Value:

Report value as defined in the FTR. Value is the selling price in U.S. dollars, plus inland or domestic freight, insurance, and other charges to the land border port of export.

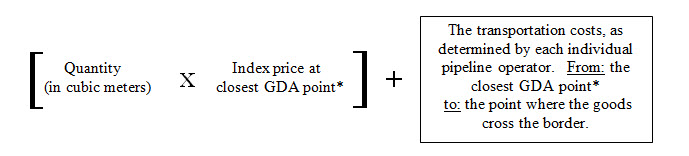

ORValue Using Gas Daily Average (GDA) Pricing:

*The GDA point selected should be the closest GDA point to the point where the Natural Gas crosses the border into Canada. Keeping this in mind, the Census Bureau does not maintain the GDA pricing or lists, and it is therefore up to the USPPI or their authorized agent to determine which GDA point is most applicable to each shipment

- United States Principal Party in Interest (USPPI):

As defined in 15 CFR, Part 30: “The person or legal entity in the United States that receives the primary benefit, monetary or otherwise, from the export transaction. Generally, that person or entity is the U.S. seller, manufacturer, or order party, or the foreign entity while in the United States when purchasing or obtaining the goods for export.”

- USPPI Address Information:

Address Line 1 (Street Address): The name of the U.S. pipeline that carries the natural gas into Canada.

City, State and Postal Code: The city, state, and zip code of the U.S. city nearest the border crossing of the pipeline.

The regulations can be found on our website at https://www.census.gov/foreign-trade/regulations.