Joint Federal Research Found That More Than 90% of Potentially Eligible Individuals Received Stimulus Payments

More than 90% of potentially eligible individuals received pandemic-related stimulus payments but receipt varied across race and ethnic groups, according to recently published joint federal research.

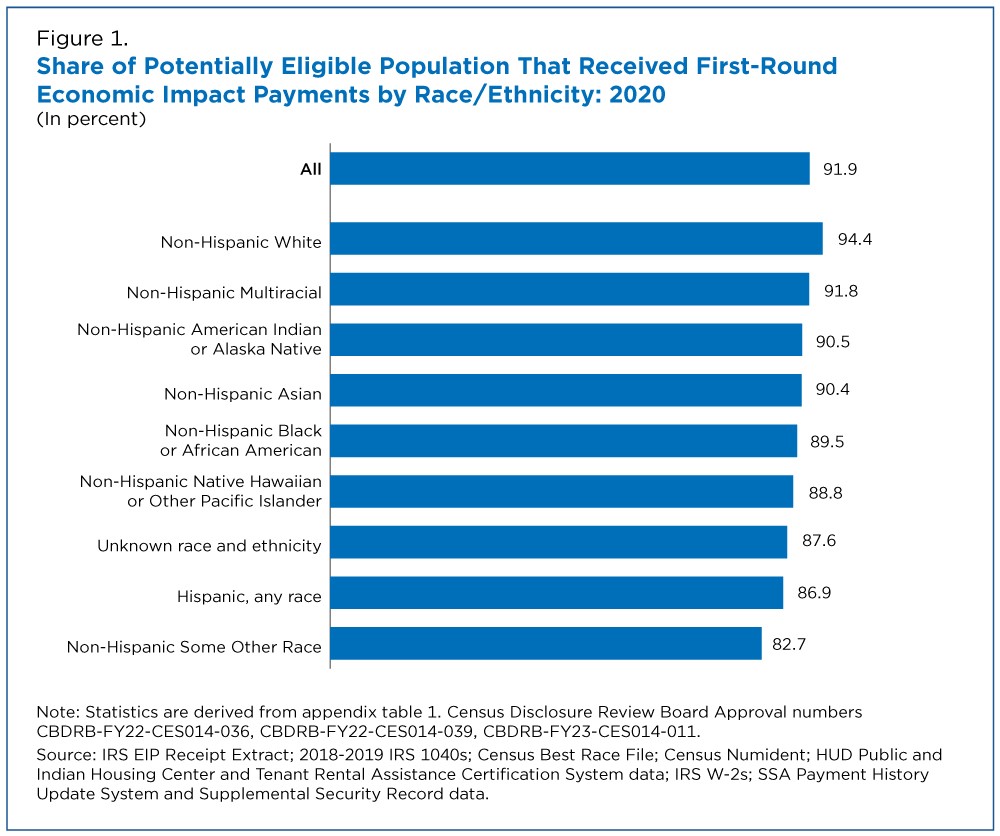

Among the four largest race/ethnic subgroups of the potentially eligible population (Non-Hispanic White, Non-Hispanic Black, Non-Hispanic Asian and Hispanic of any race), Hispanic individuals had the lowest receipt rate (87%) and non-Hispanic White individuals the highest (94%).

In addition, lower-income individuals and families with children received payments earlier than higher-income individuals and families without children.

Lower-income individuals and families with children received payments earlier, indicating that the way the IRS prioritized payments was effective.

The research published May 8 investigates whether there were disparities in the disbursement of federal Economic Impact Payments (EIPs) as part of a broader effort related to Executive Order 13985, Advancing Racial Equity and Support for Underserved Communities Through the Federal Government.

What Are Economic Impact Payments?

The onset of the pandemic in March 2020 sparked three rounds of EIPs:

- The Coronavirus Aid, Relief and Economic Security (CARES) Act created the Recovery Rebate Credit for tax year 2020.

- The Consolidated Appropriations Act (CAA) of 2021 created an Additional 2020 Recovery Rebate Credit in December 2020.

- The American Rescue Plan (ARP) Act of 2021 created a Recovery Rebate Credit for tax year 2021 in March of that year.

The research focuses only on the first-round EIPs: payments of $1,200 per eligible individual and $500 per qualifying child established by the CARES Act and issued between April 2020 and December 2020.

To measure whether EIP disbursements were equitable, the Census Bureau, IRS and U.S. Department of the Treasury joined forces through the Equitable Data Working Group. These federal agencies combined data sources — while still protecting the privacy of individuals — to conduct statistical analyses of the EIPs. The IRS is the only federal agency with information on the receipt of EIPs and the Census Bureau the only one with race and ethnicity data.

Researchers examined the disbursement of the stimulus payments by race/ethnicity, age, sex, income and household composition.

The paper focuses on two measures of EIP disbursement by demographic group: the receipt rate and the timing of payments to recipients.

The researchers estimated the receipt rate as the number of recipients as a share of the potentially eligible population — and defined the potentially eligible population as individuals who, based on Census Bureau modeling, might have met the criteria to receive a payment. While the method for identifying who was potentially eligible has some shortcomings, an estimate of the size of this group is still useful for identifying if disparities existed across demographic groups.

Researchers leveraged the census demographic data by linking it to the IRS administrative tax data for individuals and tax units (individuals who file taxes together) to arrive at the results. The information was connected inside the Census Bureau firewall.

What the Research Shows

Overall, 92% of potentially eligible individuals received EIPs: non-Hispanic White individuals were most likely to receive an EIP (94%) and Hispanic individuals and those classified as Some Other Race had the lowest (87% and 83%, respectively) receipt rates (Figure 1).

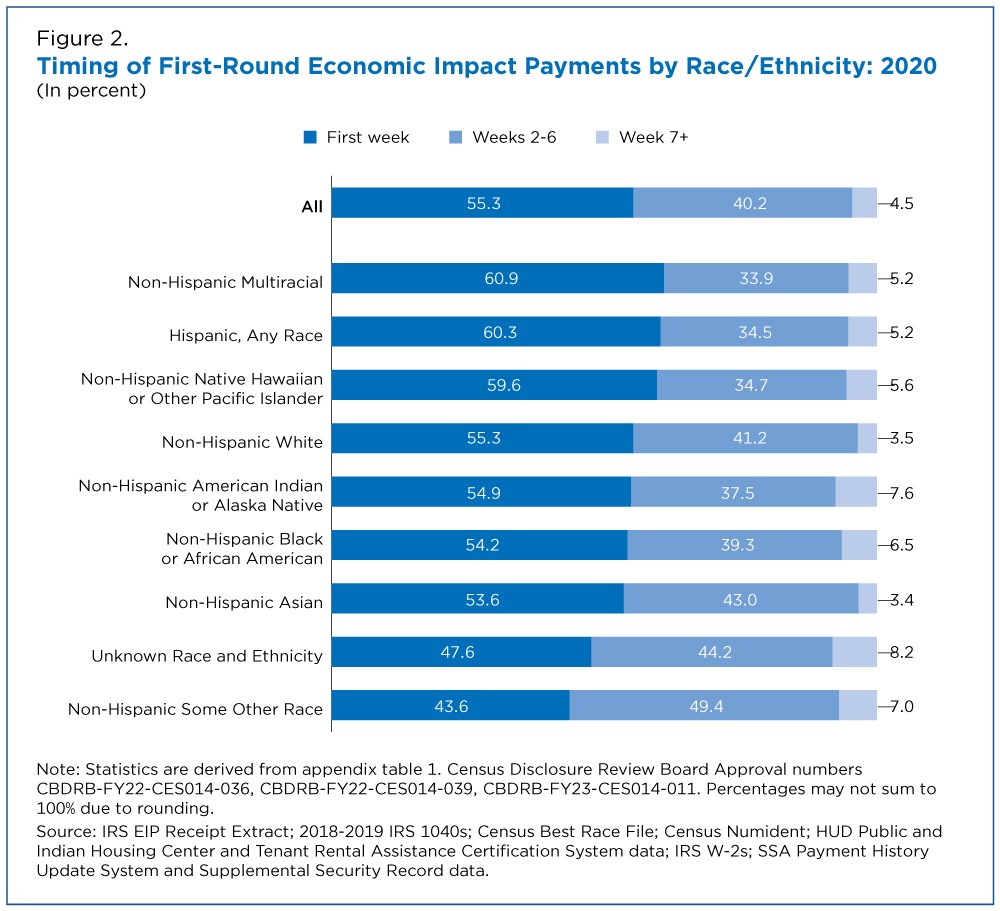

With respect to timing, 95% of recipients received payments in the first six weeks of the program and more than half (55%) in the first week of the program (Figure 2).

In addition, 90% of every race/ethnic subgroup received payments within six weeks of when EIP disbursement began, but Non-Hispanic White and Non-Hispanic Asian recipients were most likely to receive their EIPs within the first six weeks.

Lower-income individuals and families with children received payments earlier, indicating that the way the IRS prioritized payments was effective.

This research project and the detailed tabulations have provided a unique test case for the ability of federal agencies to rapidly conduct joint research to gauge the equity of the administration of assistance programs. The joint effort was possible because it linked confidential data along with the associated privacy protections, data use agreements and access controls.

Related Statistics

-

Stats for StoriesNational Poverty in America Awareness Month: January 2025The Current Population Survey Annual Social and Economic Supplement reports the official poverty rate in 2023 was 11.1%, not statistically different from 2022.

-

Data ToolMy Community ExplorerThis tool combines select demographic, business, and resilience data to help users identify potentially underserved areas of their state, county, and community.

Subscribe

Our email newsletter is sent out on the day we publish a story. Get an alert directly in your inbox to read, share and blog about our newest stories.

Contact our Public Information Office for media inquiries or interviews.

-

America Counts StoryMany American Households Use Stimulus Payments to Pay Down DebtMarch 24, 2021Millions of Americans are poised to receive a third stimulus check, one of the benefits of the American Rescue Plan Act. Many have used stimulus to pay debt.

-

America Counts StoryGovernment Assistance Lifts 45.4 Million Out of Poverty in 2021September 13, 2022The 2021 U.S. official poverty rate of 11.6% was not statistically different from 2020 but the Supplemental Poverty Measure at 7.8% was lowest on record.

-

America Counts StoryLess Hunger in At-Risk Households During Pandemic Expansion of School Meals ProgramApril 04, 2022Participation rates in free school lunch programs remain higher for lower income children even when program was expanded during the pandemic.

-

PopulationGear Up for Super Bowl LIX With Fun Facts and FiguresFebruary 06, 2025The Kansas City Chiefs and Philadelphia Eagles face off for the second time in three years, this time in New Orleans.

-

MigrationHomeward Bound: More People Moved Back Home at Height of PandemicJanuary 22, 2025Between 2019 and 2022, the share of movers who returned to their state of birth rose from about 4% to 5%.

-

EmploymentSocioeconomic Inequalities Between Remote Workers and CommutersJanuary 16, 2025Compared to commuters, home-based workers are older, more likely to be White and less likely to be in poverty.

-

VeteransWhat Are Veterans’ Job Prospects After They Serve?January 14, 2025New U.S. Census Bureau data show how veterans fare when they transition to the civilian labor force.