Medical Expenditure Panel Survey – Insurance Component Shows 86% of Private-Sector Employees Worked for Establishments that Offered Health Insurance

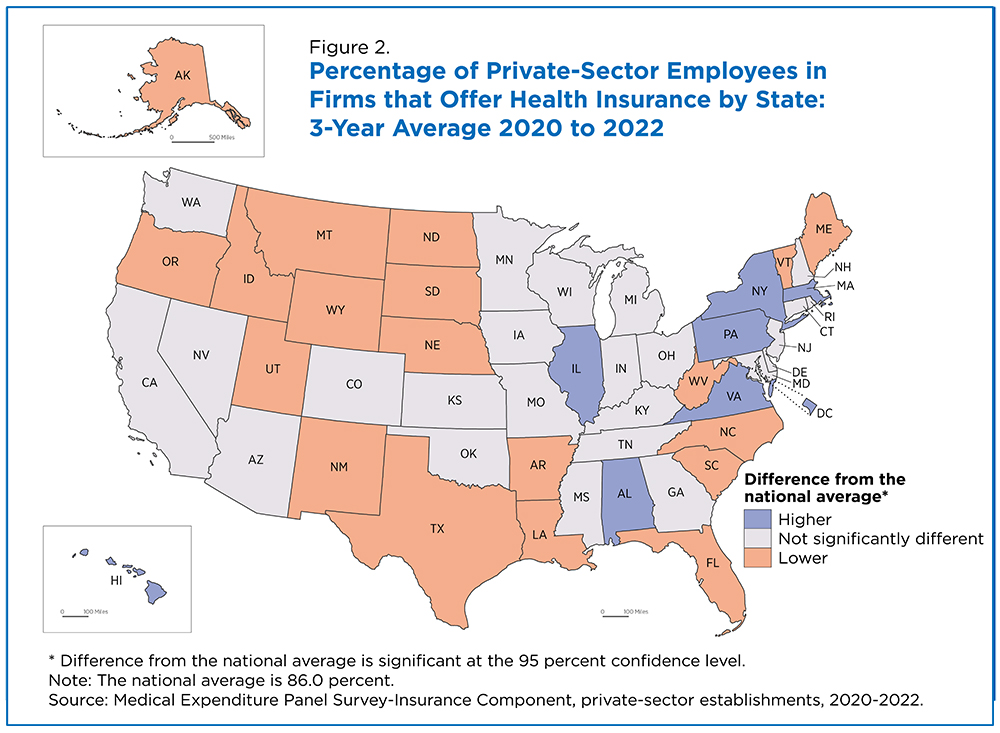

About 86% of U.S. private-sector employees worked for establishments that offered employer-sponsored health insurance, according to a 3-year average based on 2020-2022 data collected by the Insurance Component of the Medical Expenditure Panel Survey (MEPS-IC).

At the state level, the percentage of private-sector employees in establishments that offered health insurance ranged from a 3-year average low of 70.5% (Wyoming) to a 3-year average high of 97.5% (Hawaii).

In this article, 3-year average statistics are based on data collected for reference years 2020 to 2022.

At the state level, the percentage of private-sector employees in establishments that offered health insurance ranged from a 3-year average low of 70.5% (Wyoming) to a 3-year average high of 97.5% (Hawaii).

Seven states (Alabama, Hawaii, Illinois, Massachusetts, New York, Pennsylvania, and Virginia,) and the District of Columbia’s 3-year average exceeded the 3-year national average for the percentage of private-sector employees in establishments that offer health insurance.

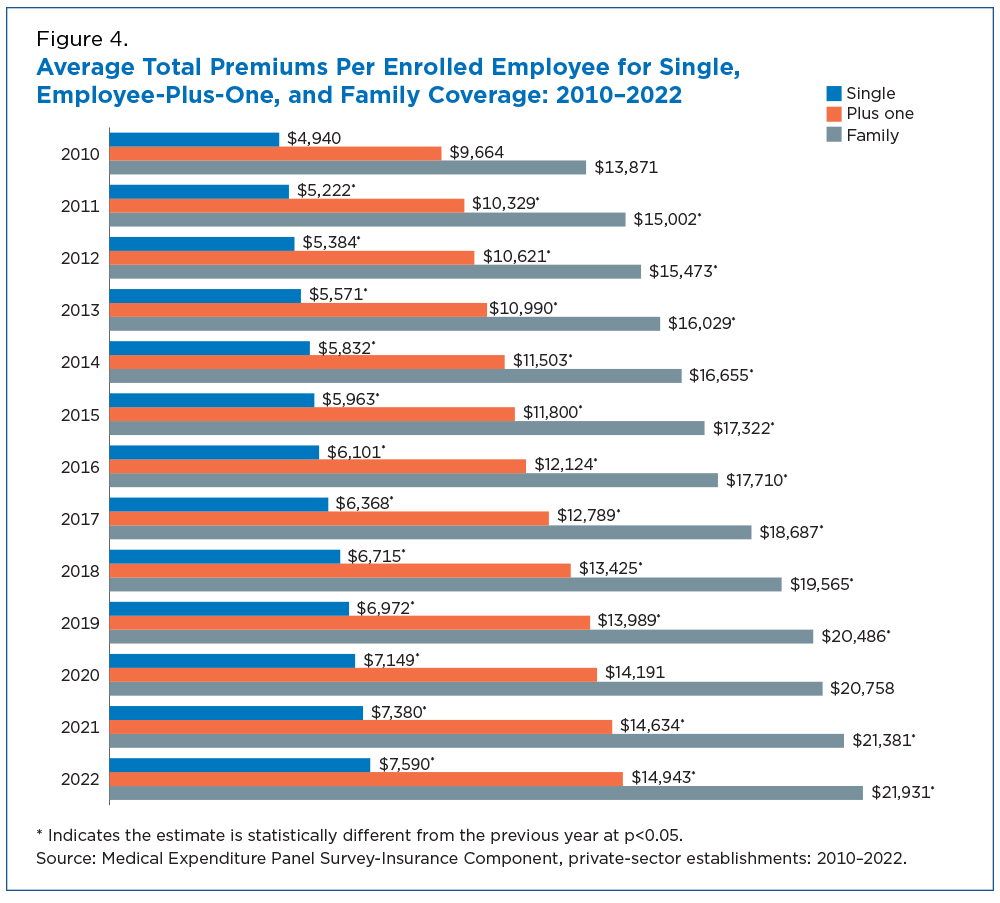

The survey also shows that average total premiums for enrolled employees have risen from $4,940 for single coverage in 2010 to $7,590 in 2022; $9,664 for employee-plus-one coverage in 2010 to $14,943 in 2022; and, $13,871 for family coverage in 2010 to $21,931 in 2022.

What is the MEPS-IC?

The MEPS-IC, conducted by the U.S. Census Bureau and sponsored by the U.S. Department of Health and Human Services’ Agency for Healthcare Research and Quality (AHRQ), annually provides the data on health insurance coverage offered by private employers and state and local governments.

In this article, we focus on MEPS-IC health coverage data offered by private employers.

The private-sector sample, which is selected annually, includes approximately 42,000 business establishments from the Census Bureau’s Business Register.

The estimates and charts from the published data are categorized by firm size. They are based on actual employment rather than full-time equivalent (FTE) counts (since the MEPS-IC does not collect FTE employment data).

Employer-Sponsored Health Insurance in the Private Sector

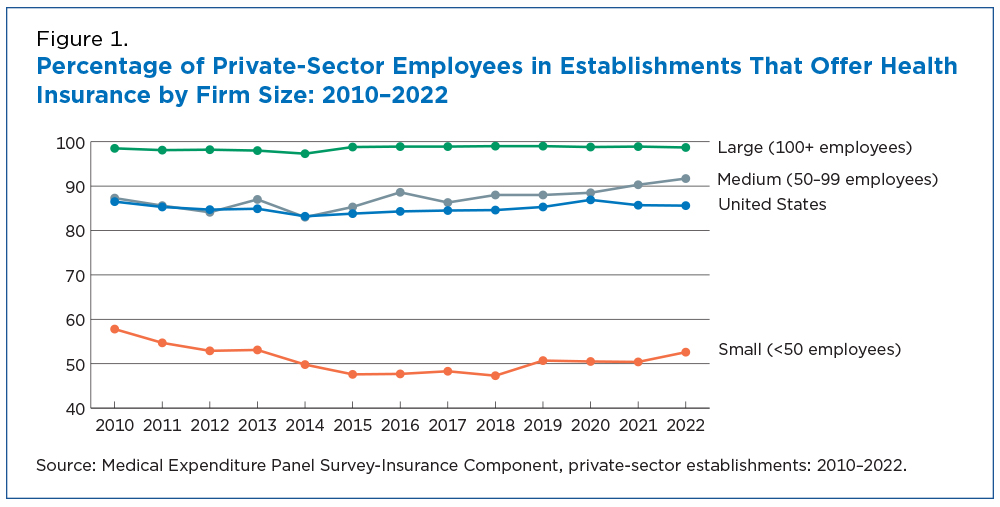

Large firms with 100 or more employees had the highest share of employees working where health insurance was offered between 2010 and 2022.

Share of Private-Sector Employees in Businesses that Offer Health Insurance

At the state level, the percentage of private-sector employees in establishments that offer employer-sponsored health insurance ranged from a low of 70.5% (Wyoming) to a high of 97.5% (Hawaii) using a three-year average.

Seven states and the District of Columbia were significantly above the national average of 86%: Hawaii (97.5%); the District of Columbia (94.6%); Massachusetts (89%); Illinois (88.8%); Virginia (88.5%); Pennsylvania (88.2%); Alabama (87.8%); and New York (87.5%).

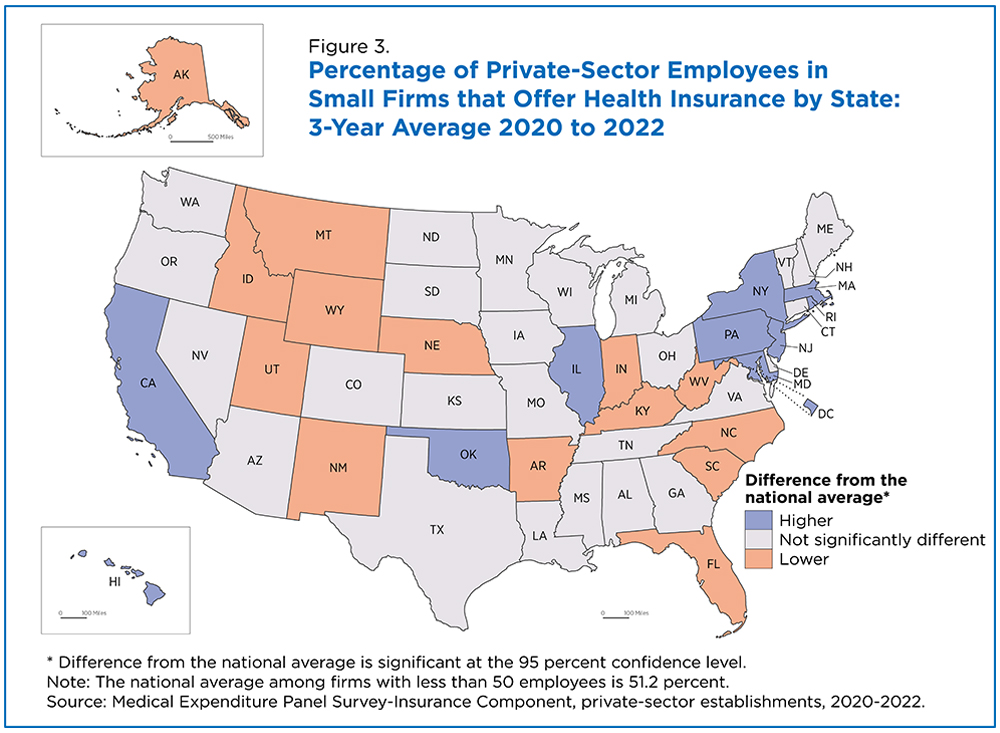

Small firms’ (those with fewer than 50 employees) share of employees working where health insurance was offered was much lower (51.2%) than the national average for firms of all sizes (86%).

In small firms, the nine states whose share was above the national average were: California (55%); Hawaii (90.6%); Illinois (55.8%); Maryland (57.3%); New Jersey (56.8%); New York (56.1%); Oklahoma (58.5%); Pennsylvania (56.3%); and Rhode Island (57.2%).

Average Total Premiums per Employee

The average total premium per enrolled employee increased for all three coverage types (single, employee-plus-one and family coverage) between 2010 and 2022. The increases were from $4,940 for single coverage in 2010 to $7,590 in 2022; $9,664 for employee-plus-one coverage in 2010 to $14,943 in 2022; and, $13,871 for family coverage in 2010 to $21,931in 2022.

How the MEPS-IC is Used

The Medical Expenditure Panel Survey - Insurance Component is the country’s most comprehensive study on health insurance benefits offered by employers. Its goal is to provide the most accurate data possible on health insurance coverage and costs to help policy makers, industry leaders and other data users make informed health care decisions. These data have been used in research analyses that help to inform policy makers and to fill knowledge gaps on this group insurance market.

For many years, health insurance coverage has been a significant recruitment incentive, which not only helps business to recruit but can also help them to retain workers. MEPS-IC data has been used as:

- A reliable economic forecasting tool. The health insurance data factor into the Gross Domestic Product or GDP, a measure used to assess the fiscal fitness of the United States.

- A valuable health benefits planning tool. Organizations can use the data to gauge how they compare to the national average.

Further research is available on the AHRQ site.

Related Statistics

Stats for Stories

Subscribe

Our email newsletter is sent out on the day we publish a story. Get an alert directly in your inbox to read, share and blog about our newest stories.

Contact our Public Information Office for media inquiries or interviews.