New Data Reveal Inequality in Retirement Account Ownership

Baby boomers, men and non-Hispanic White and Asian individuals are the nation’s most likely to own retirement accounts, according to U.S. Census Bureau data released today.

The 2021 Survey of Income and Program Participation (SIPP) includes new questions that help shine a light on how people were preparing for retirement in 2020.

It highlights differences in retirement assets by generations, sex, race, and ethnicity.

This report also updates similar estimates for 2013 from a recently released paper that used data from the 2014 Social Security Administration Supplement and the 2014 SIPP.

While members of Generation Z were least likely to own a retirement account as of 2020, they also have the most time to accumulate additional retirement savings.

Overall Ownership Rates

The SIPP has historically asked individuals to report whether they own any retirement accounts, which are categorized into:

- 401(k), 403(b), 503(b), and Thrift Savings Plans: employer-sponsored defined-contribution plans that deliver tax benefits. Employees choose how much to contribute, subject to annual contribution limits, and some employers match employee contributions.

- Individual Retirement Accounts (IRA) and Keogh accounts: defined-contribution plans that also provide tax benefits for retirement savings. Individuals choose how much to contribute, subject to annual contribution limits. The plans have account values that can provide income during retirement.

- Defined-benefit and cash balance plans: plans that typically deliver regular payments to support retirees. Payments from a defined-benefit plan often depend on an employee’s earnings and length of service, while cash balance plans define the benefit in terms of a stated account balance.

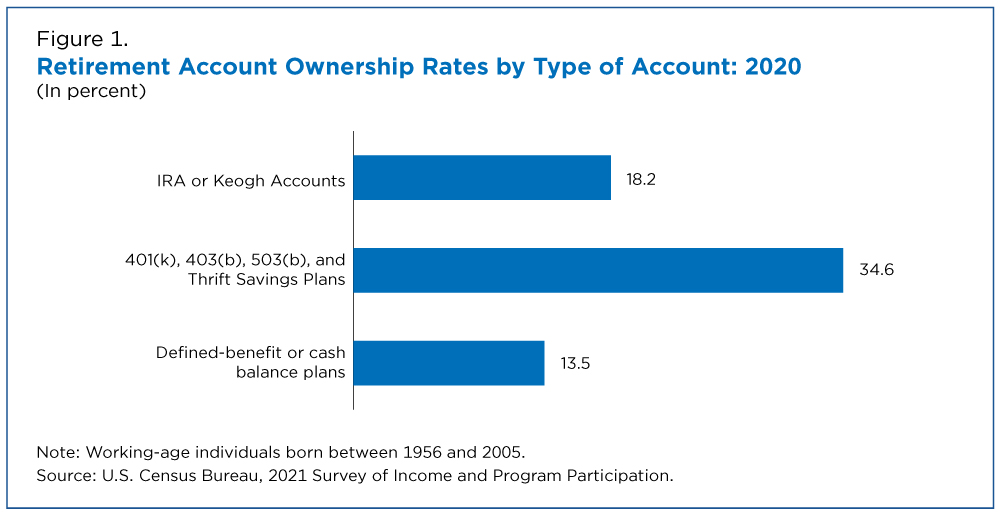

Among working-age individuals (ages 15 to 64), the most common type of retirement accounts in 2020 were 401(k)-style accounts (34.6%). About 18% of working-age individuals had an IRA or Keogh account, and 13.5% had a defined-benefit or cash balance plan.

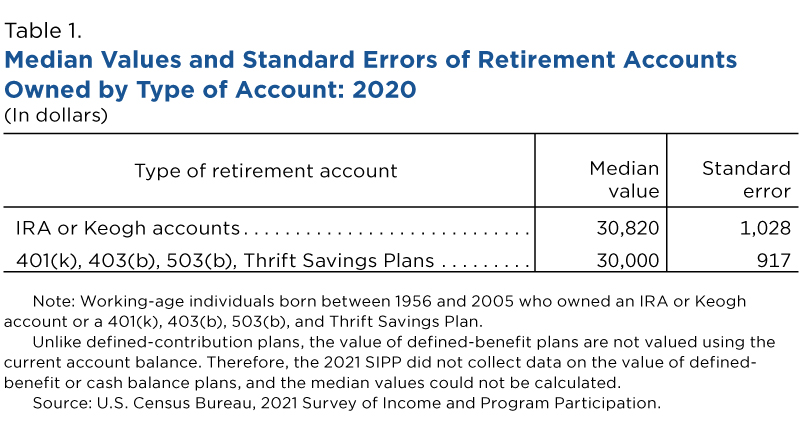

The median value of 401(k)-style accounts was $30,000 and the median IRA or Keogh value was $30,820 — not statistically different.

Demographics of Ownership

Overall rates, however, mask substantial inequality among those who own retirement accounts.

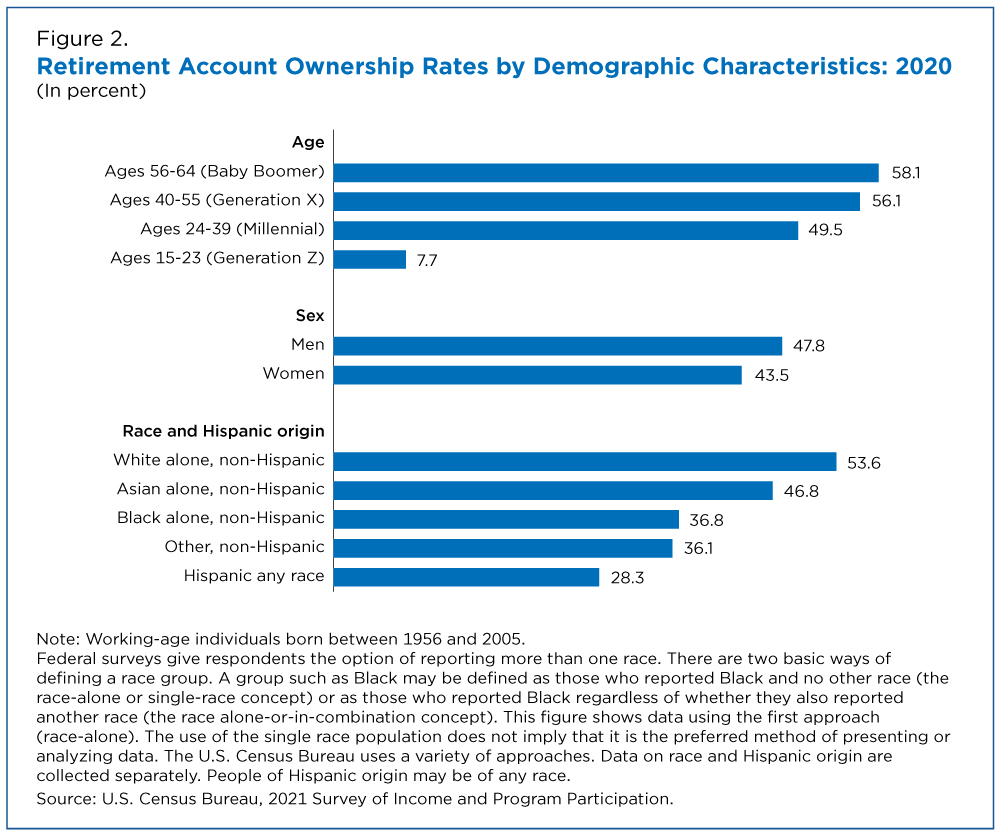

In 2020, working-age baby boomers ages 56 to 64 were the most likely to own at least one type of retirement account (58.1%).

Generation or Gen X members ages 40 to 55 were the next most likely to own retirement accounts (56.1%).

About half (49.5%) of Millennials ages 24 to 39 owned at least one type of retirement account but only 7.7% of Generation or Gen Z members ages 15 to 23 owned a retirement account.

While members of Generation Z were least likely to own a retirement account as of 2020, they also have the most time to accumulate additional retirement savings. According to previous work showing SIPP estimates for 2013, only 17.7% of Millennials owned retirement accounts when they were ages 15 to 31.

Current SIPP estimates show how Millennials’ retirement account ownership grew as they aged and gained labor market experience. Future SIPP estimates will show the evolution of retirement account ownership for Gen Z members as they age and accumulate labor market experience.

Men were slightly more likely (47.8%) than women (43.5%) to own a retirement account in 2020.

There were also differences in ownership by race and Hispanic origin.

About 54% of non-Hispanic White individuals owned a retirement account, and 46.8% of non-Hispanic Asian individuals owned a retirement account.

About 37% of non-Hispanic Black individuals and 36.1% of “Other” non-Hispanic individuals (i.e., American Indian or Alaska Native, Native Hawaiian or Other Pacific Islander or multiracial) owned at least one retirement account but the difference is not statistically significant.

Ownership rates (28.3%) were lowest among Hispanic individuals.

Saving for Retirement

The 2021 SIPP featured new questions on employee and employer contributions to retirement accounts sponsored by an individual’s main employer. For each account type, individuals were asked whether they made contributions, and if so, how much.

This article focuses on employee contributions but the SIPP also asked owners of 401(k)-style and IRA or Keogh accounts whether their employer made contributions, and if so, the amount contributed.

The amount individuals receive from their defined-contribution plans (401(k)-style and IRA or Keogh accounts) when they retire is based on contributions and investment gains or losses.

Although employees may contribute to a pension plan, defined-benefit plans guarantee a specified monthly benefit at retirement based on salary history and length of service, rather than total contributions and investment returns.

Some individuals may own retirement accounts without actively making contributions.

Consider an individual who quits a job with an employer-sponsored 401(k) to open their own business. They still have that 401(k) but can no longer contribute. Others may be experiencing financial hardship that prevents them from contributing to their retirement accounts.

So, to understand how people save for retirement, we need to consider not only who owns retirement accounts but also who contributes to their retirement accounts and the value of those contributions.

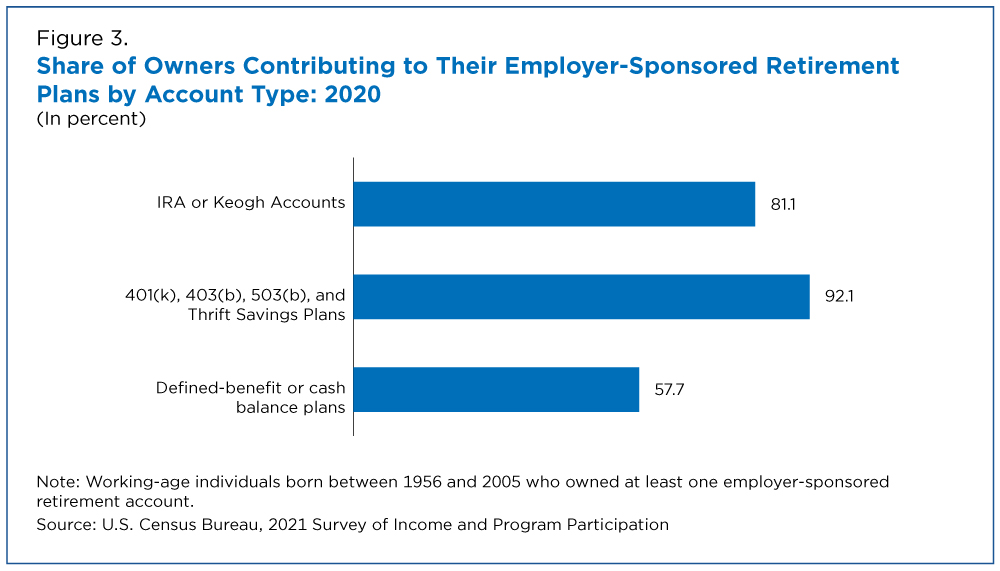

In 2020, 92.1% of 401(k)-style account owners and 81.1% of IRA or Keogh account owners contributed to their employer-sponsored retirement accounts, regardless of the frequency of their contributions. A smaller share (57.7%) of pension holders contributed to their employer-sponsored defined-benefit or cash balance plan.

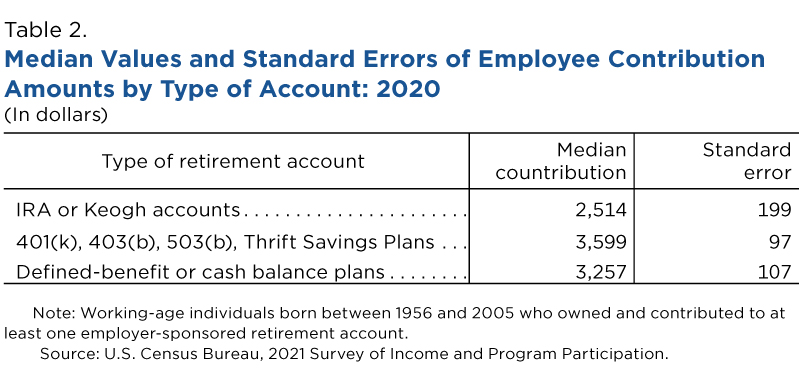

The median total amount employees contributed in 2020 to their own IRA or Keogh account was $2,514. The median amount they contributed to their 401(k)-style accounts ($3,599) and pension plans ($3,257) was slightly higher. Future research will examine employer contributions in combination with employee contributions.

What Is the SIPP?

The Survey of Income and Program Participation is a nationally representative longitudinal survey administered by the U.S. Census Bureau that provides comprehensive information on the dynamics of income, employment, household composition and government program participation.

Beginning with the 2021 interview, the SIPP asked a series of questions sponsored by the Social Security Administration (SSA) about employer-sponsored retirement and pension plan coverage. These questions are a revised version of questions included in the 2014 SSA Supplement and the Retirement and Pension Plan Coverage Topical Module administered as far back as the 1984 SIPP panel.

The new questions provide insight into employer-sponsored retirement plans offered by current and prior employers, income withdrawn or received from these accounts and amounts contributed to retirement accounts by employers and employees.

Survey statistics are subject to sampling and nonsampling error. For technical documentation and more information about SIPP data quality, visit the Technical Documentation page.

Maria G. Hoffman and Mark A. Klee are survey statisticians in the Census Bureau’s Social, Economic, and Housing Statistics Division.

Briana Sullivan is an economist in the Social, Economic, and Housing Statistics Division.

Related Statistics

Stats for Stories

Subscribe

Our email newsletter is sent out on the day we publish a story. Get an alert directly in your inbox to read, share and blog about our newest stories.

Contact our Public Information Office for media inquiries or interviews.