Households With Children That Struggled to Cover Household Expenses Were at Least Twice as Likely to Rely on CTC

More households with children had difficulty paying for usual household expenses after Child Tax Credit (CTC) payments ended in December, according to new Household Pulse Survey (HPS) results.

The U.S. Census Bureau’s HPS previously showed that reports of hardship among households with children decreased when CTC payments began in July 2021.

The Internal Revenue Service issued a monthly advance CTC payment to households with children from July to December 2021. More than 36 million families received the last monthly payment of up to $300 for each child ages 5 and under and up to $250 for each child ages 6 to 17.

In late January and early February 2022, after payments ended, 35% of adults living in households with children said they struggled to cover usual costs.

The experimental HPS collected data during the second half of 2021 (August through December) while advance CTC payments were issued and in early 2022, after the payments stopped.

The survey asked households whether they had received a CTC payment within the last four weeks.

When asked in August, October and December, about half of households with children said they had received a payment.

Families Feeling the Pain of Losing CTC Payments

For a family of four with two children under age 5, the maximum monthly payment of $600 was equivalent to more than 25% of the 2021 poverty guideline for a month.

The HPS asked respondents how difficult it was to cover usual household expenses during the prior week. For this story, households with children are considered to have trouble making ends meet if they reported that it was “somewhat” or “very difficult” to cover expenses.

During the months CTC payments were distributed, about 30% of households with children reported difficulty meeting expenses.

In late January and early February 2022, after payments ended, 35% of adults living in households with children said they struggled to cover usual costs.

Covering Household Expenses

Both while monthly CTC payments were distributed and after they stopped, many households with children used regular income (like sources received before the COVID-19 pandemic) to cover weekly expenses.

However, when receiving the CTC, those payments became an important source of income: about 1 in 4 households with children reported using them to cover expenses.

Households with children that reported difficulty covering expenses were more likely than those that didn’t report hardship to rely on credit cards or loans.

In addition, households with children that struggled were at least twice as likely to use monthly CTC payments to cover expenses. They were also at least eight times more likely to borrow money from family or friends.

In early 2022, after CTC payments ended, the types of income households with children relied on to cover expenses didn’t change significantly. Most still heavily relied on regular income and credit cards or loans.

The big change was that families were no longer receiving CTC payments.

How CTC Payments Were Spent

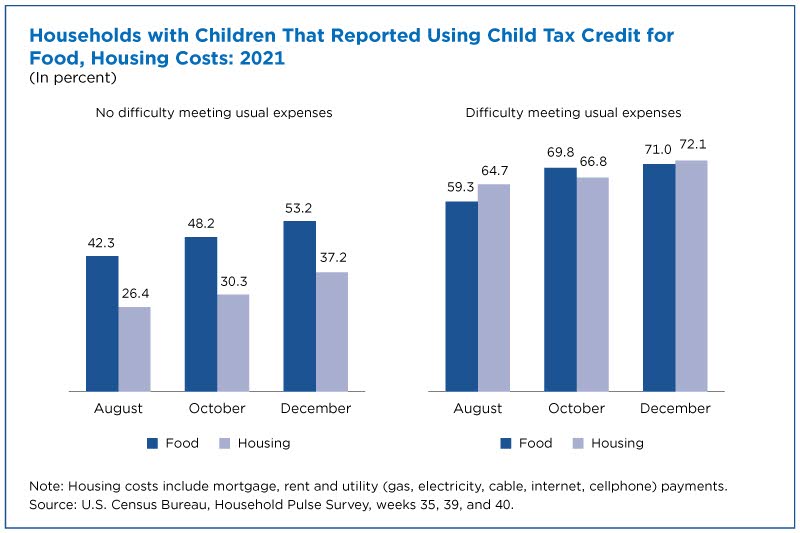

In the fall of 2021, the HPS asked households that reported receiving CTC what they spent it on.

They consistently reported using it to meet basic needs, such as buying food and covering housing expenses, including rent, mortgage or utilities (gas, electricity, cable, internet, cellphone).

Households that struggled with expenses were even more likely to report spending the CTC on basic needs.

For example, 72% of households with children that reported difficulty with expenses said they spent their CTC on rent, mortgage or utilities in December, compared to 37% of those that did not report difficulty.

About HPS

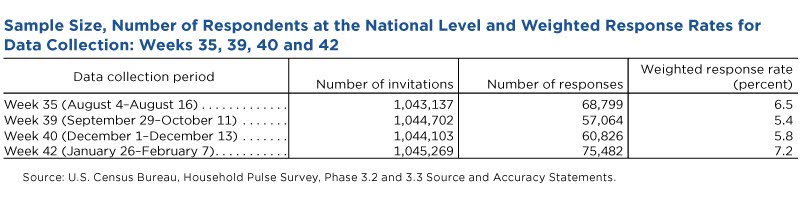

The HPS is designed to provide near real-time data on how the COVID-19 pandemic is affecting Americans’ lives. Information on the methodology and reliability of these estimates can be found in the source and accuracy statements for each data release.

Data users interested in state-level sample sizes, the number of respondents, weighted response rates and occupied housing unit coverage ratios can consult the quality measures file available at the same location.

These data were collected over four survey cycles starting August 4, 2021, and ending February 7, 202, during which the HPS was sent to more than 1 million adults in households every two weeks.

Related Statistics

Stats for Stories

Stats for Stories

Stats for Stories

Subscribe

Our email newsletter is sent out on the day we publish a story. Get an alert directly in your inbox to read, share and blog about our newest stories.

Contact our Public Information Office for media inquiries or interviews.