Census Statistics Show Early Impact of COVID-19 Pandemic on Game Console Launch

What promised to be one of the holiday season’s hottest commodities suffered a setback last year when the video game industry’s largest trade show, E3 Expo, was cancelled amid COVID-19 concerns.

Even though the E3 Expo returned this year, it was held virtually, again because of pandemic concerns.

A consumer could purchase the next generation of consoles from a variety of stores. Where they buy ultimately changes how their purchase is reflected in retail trade data.

Historically, gaming companies have used the E3 trade show to tease, reveal and provide updates on new and upcoming software titles for the major video game platforms. Anticipation and excitement remain for the latest gaming hardware and software updates for the 9th generation of video game consoles released late last year.

In the video game industry, this hype translates into product preorders typically fulfilled as products launch around the holiday season. When these products flow through the supply chain, they are represented in U.S. Census Bureau statistics in different ways.

A New Generation of Consoles Through the Supply Chain

We traced the theoretical journey of a product to the store shelf in a previous webinar: Wholesale, Retail, and International Trade Indicators in a Global Marketplace. Here, we do the same with video game consoles (Figure 1).

Let’s say that the current generation of video game consoles are manufactured overseas. A wholesale distributor imports shipping containers full of consoles to the United States. The wholesaler then sells several cases of video game consoles to retailers to stock their shelves.

Finally, consumers purchase an individual gaming console at their favorite online or in-store retailer as a holiday gift or to upgrade their gaming experience.

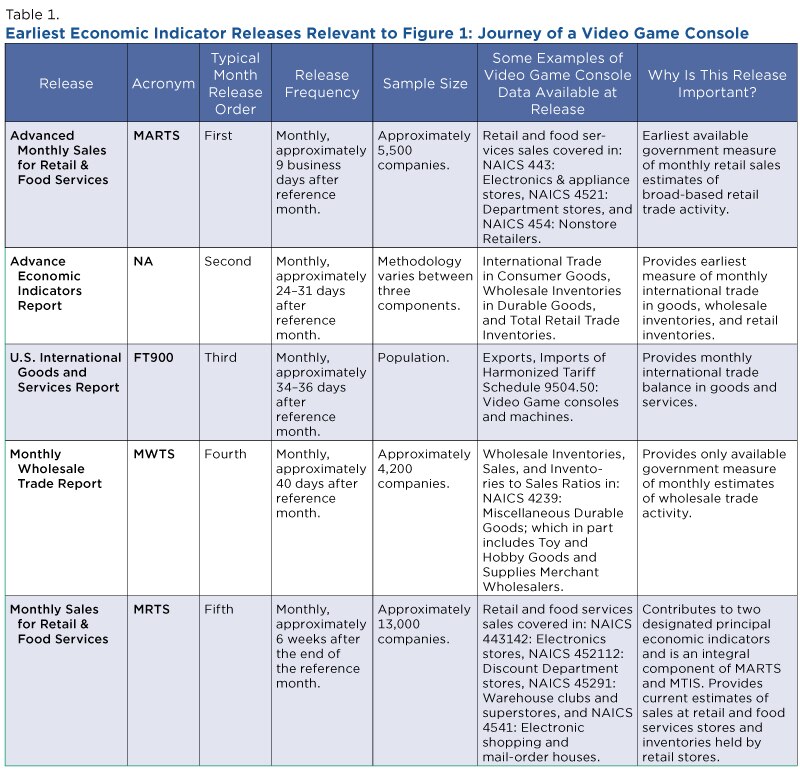

In this common scenario, as video game consoles move through different sectors of the supply chain, the data are reflected in as many as five different economic indicator releases published by the Census Bureau (Table 1).

Why five? Because each release only tells a portion of the story at a given point in time.

For instance, when the Census Bureau and the Bureau of Economic Analysis release the FT-900 Report, their joint report on the aggregate international data, they also provide more granular commodity level data the same day through USA Trade Online.

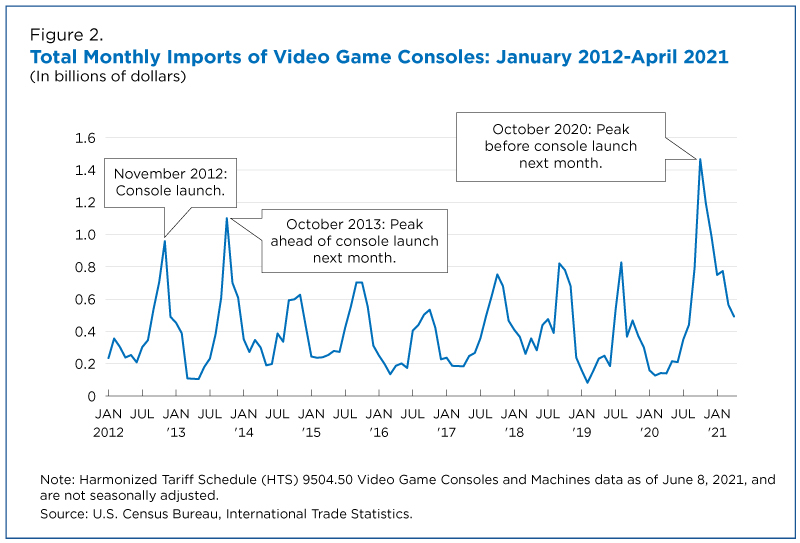

You can track the first phase of the supply chain through the value of imported video game consoles using video game console data from USA Trade Online (Figure 2).

As the console cargo is offloaded into the wholesale sector, the measurement of the wholesale sale of consoles to retailers is in part captured by the Monthly Wholesale Trade Report’s (MWTS) estimates for the North American Industry Classification System (NAICS) Miscellaneous Durable Goods, an industry which includes Toy and Hobby Goods and Supplies Merchant Wholesalers.

When retailers sell the consoles to consumers, this data can be tracked at multiple checkpoints depending on the desired timeliness and level of detail.

Retail Trade’s Advance Monthly Retail Trade Report (MARTS) provides the timeliest snapshot of the supply chain — as early as nine business days after the end of the month. That’s significantly faster than the Monthly Sales for Retail and Food Services (MRTS) which is available approximately six weeks after the end of the month.

In addition to both of these retail trade releases, the Advance Indicators Report offers the earliest measure of retail inventories, wholesale inventories, and international trade in goods. However, the timeliness of the Advance Indicators Report comes at a tradeoff: It provides only highly aggregate statistics.

As data releases move farther away from the reference period, the data typically become more granular.

Imagine tweaking the lens on a projector. At first the image is blurry, but you can generally see what’s going on. With each adjustment, the image gets clearer and clearer. In the case of economic data, these adjustments come at the expense of timeliness: Annual releases are not as current as monthly releases but are more detailed.

From Overseas to Under Christmas Trees

Since we last highlighted Imports of Video Game Consoles in 2011, the 8th generation of consoles launched and their Harmonized Tariff Schedule code for was re-classified from HTS 9504.10 to 9504.50.

Historically, imports soared ahead of Christmas, the industry’s peak retail sales period (Figure 2). The three highest peaks from January 2012 to January 2021 were when new video game hardware were launched in November 2012; November 2013; and in November 2020, a month before the retail launches.

Following Console Sales Through Retailers

A consumer could purchase the next generation of consoles from a variety of stores. Where they buy ultimately changes how their purchase is reflected in retail trade data.

For instance, if a consumer purchased the game console from an electronics store, their data would be reflected in NAICS Electronics Stores, a highly seasonal industry that spikes around the holidays (Figure 3).

Growing Field of E-Sports Shows Up in Services Data

Supply disruptions triggered by events like COVID-19 aren’t the only ongoing considerations the Census Bureau notes when measuring the economy. As new and emerging services, products and technologies are introduced into the economy, the Census Bureau adapts its collection to ensure these new inputs are accurately measured in its statistics.

Typically, the earliest capture of these segments occurs across the Census Bureau’s 13 economic indicators. One of these indicators, the Quarterly Services Report, can tell us a lot about the blossoming e-sports scene — namely, transactions when services are provided.

E-sports, short for electronic sports, are now hosting their competitive leagues and tournaments in the same stadiums and arenas where major professional sports events are held.

These events collect revenue from ticket sales and sell broadcasting rights for both cable television and online streaming.

As the e-sports industry develops and grows, these emerging areas may necessitate a breakout NAICS classification of their own. However, until criteria are met to establish a breakout, data users should expect to find e-sports services represented under the following services categories:

- Broadcasting (except Internet) includes television broadcasting, cable, and other subscription programming.

- Other Information Services includes internet publishing and broadcasting.

- Software Publishers includes games, computer software, and publishing.

- Spectator sports.

- Promoters of Performing Arts, Sports, and Similar Events.

- Other Similar Organizations (except Business, Professional, Labor, and Political Organizations).

Have questions? This webinar will show you how to avoid common data literacy pitfalls and how to interpret and get the most out of Census Bureau data.

John Sperry is a survey statistician in the Census Bureau’s Economic Indicators Division.