Mom and Pop Business Owners Day: March 29, 2024

Mom and Pop Business Owners Day: March 29, 2024

From Census.gov / America Counts: Stories / What Is a Small Business?

To many, a small business is based on the amount of money it makes and number of employees at all (rather than at each) of its business locations.

This definition of “size” aligns with the U.S. Small Business Administration’s (SBA) definition of a small business. SBA’s Table of Size Standards provides definitions for North American Industry Classification System (NAICS) codes that vary widely by industry, revenue and employment.

It defines small business by firm revenue (ranging from $1 million to over $40 million) and by employment (from 100 to over 1,500 employees).

From the Corporate Finance Institute: What Is Mom-and-Pop?

“Mom-and-pop shops are usually family owned and controlled. With limited capital investment, they handle small business volumes and run with minimal numbers of employees. Typically, the shops are not franchised and only operate at single locations. Therefore, their customers are mostly from local communities. Their products and services are more personalized.

“Mom-and-pop stores are generally in the structures of partnership, limited liability company or an S corporation. By starting up a store as a limited liability company, the owner is not personally liable for the debts carried by the store.”

Key Stats

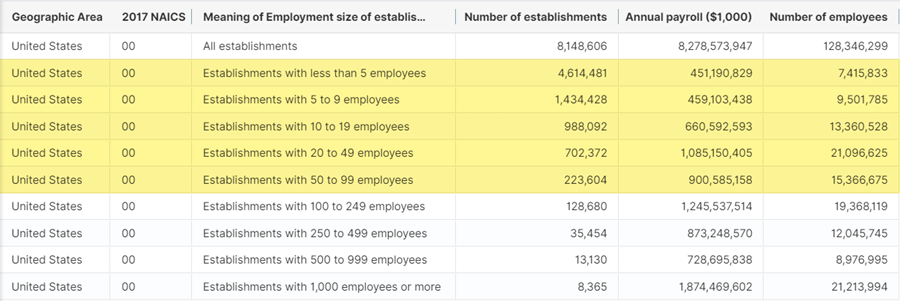

Source: 2021 County Business Patterns (CBP)

Note: The table below is cropped to list the rows for all establishments in the United States. The five rows with less than 100 employees are highlighted. Several columns are hidden. North American Industry Classification System (NAICS) code 00 reflects the sum of all the economic activity for all sectors. Click on the image for the full table.

More Stats

From Topics / Business and Economy / Small Business:

Here you will find detailed statistics about U.S. businesses that are essential to help small businesses succeed and grow.

From Data / Census Academy:

Source: Longitudinal Employer-Household Dynamics (LEHD) program.

About Us: Part of the Center for Economic Studies at the U.S. Census Bureau, the LEHD program produces cost effective, public-use information combining federal, state and Census Bureau data on employers and employees under the Local Employment Dynamics (LED) Partnership. State and local authorities increasingly need detailed local information about their economies to make informed decisions.

Note: Job-to-Job Flows Explorer is a web-based analysis tool that enables comprehensive access to an innovative set of statistics on worker reallocation in the United States. Workers often build their careers through job-hopping and this flow between jobs are a primary means by which workers move up their career ladders.

Note: OnTheMap is a web-based mapping and reporting application that lists where workers are employed and where they live. It also provides companion reports on age, earnings, industry distributions, race, ethnicity, educational attainment, and sex.

Note: QWI Explorer is a web-based analysis tool that enables comprehensive access to the full depth and breadth of the Quarterly Workforce Indicators (QWI) dataset. Through charts, maps, and interactive tables, users can compare, rank and aggregate QWIs across time, geography, firm, and worker characteristics on the fly. Here is a detailed example of Firm Size.

Source: Business Dynamics Statistics (BDS), 2021 back to 1978

Note: Under “Settings” and “X-AXIS,” select from the drop down menu “Firm Size,” “Establishment Size,” “Initial Firm Size” or “Initial Establishment Size.” Sizes are 1 to 19, 20 to 499, and 500 or more.

Source: Small Business Pulse Survey (SBPS): Tracking Changes During The Coronavirus Pandemic

Note: The target population is all nonfarm, single-location employer businesses with 1-499 employees and receipts of $1,000 or more in the 50 states, the District of Columbia, and Puerto Rico.

Source: Statistics of U.S. Businesses (SUSB) 2021 back to 1988

Source: Nonemployer Statistics (NES) 2020

NES is an annual series that provides subnational economic data for businesses that have no paid employees and are subject to federal income tax. The data consist of the number of businesses and total receipts by industry. Most nonemployers are self-employed individuals operating unincorporated businesses (known as sole proprietorships).

From the Library / America Counts: Stories:

From the Newsroom / Stats for Stories (SFS):