Estimated Revenue Increased for Internet-Based Services, Lagged for Some Traditional Media

The last two decades bore witness to a marked explosion in information-sharing readily available at our fingertips via mobile devices and touchscreens. As a result, many industries in the Information sector have grown at a markedly rapid rate.

How Information Industries Fared in the Digital Age:

The U.S. Census Bureau's 2022 Service Annual Survey (SAS) estimates that revenue of employer firms in the Internet Publishing and Broadcasting and Web Search Portals industry soared 181.9% from $120.2 billion in 2015 to $338.7 billion in 2022.

This industry, which includes firms that provide social media and video and audio streaming services, has been one of the Information sector's largest revenue contributors.

Demand has been rising: the share of adults who reported using the internet rose from 86% in 2015 to 95% in 2023, according to the Pew Research Center.

The SAS shows that in 2020, the industry's one-year revenue increased by $27.0 billion – and jumped another $66.1 billion the following year.

In contrast, revenue of industries not dependent on the internet to disseminate their services such as Radio Stations and Newspaper Publishers did not enjoy the same revenue hikes.

Telephone Communications

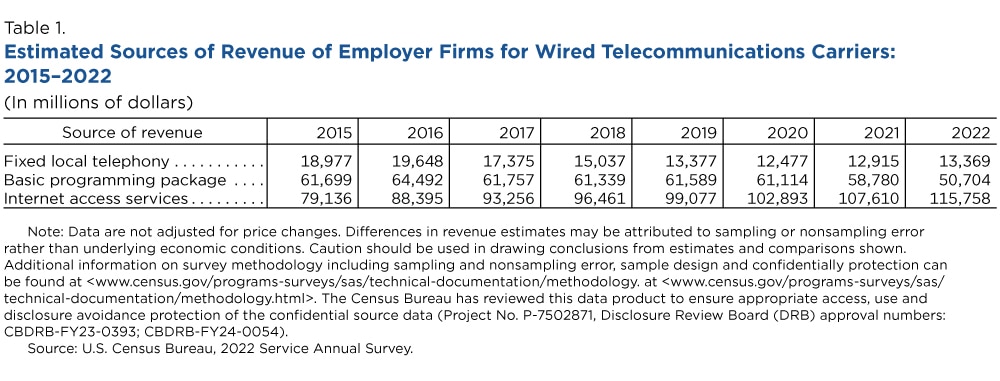

Wired Telecommunications Carriers experienced a 29.6% drop in employer revenue generated through fixed local telephony services from 2015 to 2022, according to the SAS.

Meantime, the industry's revenue from internet access services increased 46.3% from $79.1 billion in 2015 to $115.8 billion in 2022.

Data from the Centers for Disease Control shows the shift from landline to wireless (cellular) phones.

In 2015, 47.7% of U.S. adults lived in a wireless-only household and 43.7% in a household with both landline and wireless service. By 2022, the share of adults living in wireless-only households had jumped to 72.6% while the share in households with both landline and wireless had dipped to 25.4%.

During the same period, the share of adults living in landline-only households dropped from 5.8% in 2015 to 1.3% in 2022.

Cable and Telecommunications

Revenue of Cable and Other Subscription Programming, an industry comprised of companies like cable networks with studios and facilities for broadcasting programs, grew 12.6% from $82.1 billion in 2015 to $92.4 billion in 2022, according to SAS data.

Research by the Leichtman Research Group bolsters these findings, showing that 83% of U.S. households subscribed to a top subscription video on-demand or SVOD service in 2022 compared to 52% in 2015.

At the same time, according to the SAS, revenue for basic programming packages in the Wired Telecommunications Carriers industry slid 17.8%. This industry includes companies that operate transmission facilities and the infrastructure that provide telecommunication services, including cable distribution providers.

But so-called cord cutting continued to climb: the share of Americans who said they watched cable or satellite television tumbled from 76% in 2015 to 56% in 2021, according to the Pew Research Center.

Radio and Publishing

Employer firms' estimated Radio Networks revenue increased 63.3%, from $6.7 billion in 2015 to $10.9 billion in 2022, in line with a Statista report that showed online radio weekly consumption grew from 44% in 2015 to 67% in 2022.

Radio Stations' estimated employer revenue remained statistically unchanged ($12.7 billion in 2015 and $12.3 billion in 2022).

Radio networks primarily assemble and transmit aural programming to their affiliates or subscribers via over-the-air broadcasts, cable, satellite or streaming services, while radio stations primarily broadcast these programs by radio.

Print media has experienced a decline in revenue. Newspaper Publishers' estimated revenue dropped by 13.4%, from 2015 to 2022.

The latest 2022 SAS includes estimates and accompanying measures of sampling variability and sheds some light on additional industries like those outlined in this article.

Related Statistics

Subscribe

Our email newsletter is sent out on the day we publish a story. Get an alert directly in your inbox to read, share and blog about our newest stories.

Contact our Public Information Office for media inquiries or interviews.

-

Computer and Internet UseMapping Impacts of Federal Broadband Investments on Local CommunitiesFebruary 28, 2023New ACCESS BROADBAND Dashboard helps users assess broadband availability and adoption and evaluate how it impacts their local economies.

-

Business and EconomyHow Many U.S. Businesses Use Artificial Intelligence?November 28, 2023The Business Trends and Outlook Survey shows that only 3.8% of businesses use AI to produce goods and services but use varies by sector.

-

Business and EconomyInternet Crushes Traditional Media: From Print to DigitalJune 07, 2022Latest Census Bureau Service Annual Survey shows decline in revenue for Newspaper, Magazine and Video Tape/Disc Rental Industries.

-

IncomeHow Income Varies by Race and GeographyJanuary 29, 2026Median income of non-Hispanic White households declined in five states over the past 15 years: Alaska, Connecticut, Louisiana, Nevada, and New Mexico.

-

HousingRental Costs Up, Mortgages Stayed FlatJanuary 29, 2026Newly Released American Community Survey compares 2020-2024 and 2015-2019 housing costs by county.

-

HousingShare of Owner-Occupied, Mortgage-Free Homes Up in 2024January 29, 2026The share of U.S. homeowners without a mortgage was higher in 2024 than a decade earlier nationwide and in every state, though not all counties saw increases.

-

PopulationU.S. Population Growth Slowest Since COVID-19 PandemicJanuary 27, 2026The decline in international migration was felt across the states, though its impact varied.