Determining Value & License Value

Determining Value & License Value

Are you in the business of exporting licensed shipments? It sure can be tricky! If you haven’t heard already, requirements for filing licensed goods in the Automated Export System (AES) recently changed. In addition to reporting the value, you are required to report license value in the AES. Let’s take a look at how to determine value and license value to ensure you avoid costly mistakes.

Value vs License Value

Value

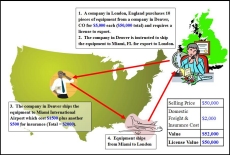

Just to remind you, value is a mandatory data element in the AES. Value = selling price OR cost of goods (if not sold) + inland or domestic freight, insurance, and other charges to the U.S. seaport, airport, or land border port of export.

License Value

License value, or Licensable Value in the AES, is a conditional data element. This means if your shipment requires an export license, you must report the value designated on the export license that corresponds to the commodity being exported.

The example below includes a shipment requiring an export license. Notice that the value is slightly higher than the licensable value. This is due to the inclusion of domestic freight and insurance costs, which is included in value only.

If you have questions regarding value or license value, please contact the Trade Regulations Branch at (800)-549-0595, Option 3 or e-mail [email protected].