The Automated Export System (AES) Compliance Review Program

The Automated Export System (AES) Compliance Review Program

The AES Compliance Review Program is our annual outreach effort to visit noncompliant companies and provide filing resources, training and expertise tailored to those companies who need it most.

The goals of the program are to:

- Help noncompliant companies understand the export reporting requirements.

- Work with companies to develop and implement best practices to ensure compliance and reporting accuracy.

- Help companies avoid costly encounters with government enforcement agencies due to noncompliance.

The AES Compliance Review Program’s proactive approach is designed to combat noncompliance with the Foreign Trade Regulations (FTR), which can result in fines, penalties, seizures or cargo delays at the port.

How Are Companies Identified as Noncompliant?

Noncompliance can be caused by many factors. With that in mind, companies can be identified as noncompliant for a multitude of reasons. The justifications include but are not limited to:

- Poor Filing Practices — Low monthly AES compliance rate, late filing or failing to resolve fatal errors.

- Misclassification — Filing incorrect Schedule B or Harmonized Tariff Schedule (HTS) numbers, filing with foreign currency, filing with incorrect units of measure, or failing to verify information with a commodity analyst.

- Violating the FTR — Failure to file a Voluntary Self-Disclosure is noncompliance with the FTR.

Impact on AES Compliance

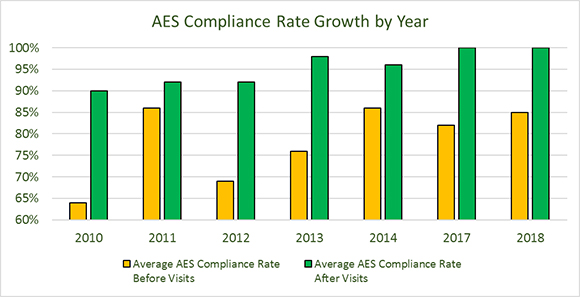

The AES Compliance Review Program works to correct compliance problems before intervention from enforcement agencies, while providing companies direct contact with subject-matter experts. As a result, companies are able to determine who to work with and how to resolve their issues quickly, leading to an increase in their AES compliance rate. While not all factors are incorporated into its calculation, a 100 percent AES compliance rate should be a standing goal for all AES filers. The historical data below illustrates this program’s direct impact on AES compliance rates.

AES Compliance Review Program Historical Data

| Year | Number of Companies Visited |

Average AES Compliance Rate Before Visits |

Average AES Compliance Rate After Visits |

Compliance Improvement |

|---|---|---|---|---|

| 2010 | 23 | 64% | 90% | 26% |

| 2011 | 7 | 86% | 92% | 6% |

| 2012 | 18 | 69% | 92% | 23% |

| 2013 | 13 | 76% | 98% | 22% |

| 2014 | 13 | 86% | 96% | 10% |

| 2017 | 15 | 82% | 100% | 18% |

| 2018 | 13 | 85% | 100% | 15% |

Source: U.S. Census Bureau, author's calculations.

Note: 2015 and 2016 data were not available.

Source: U.S. Census Bureau, author's calculations.

Note: 2015 and 2016 data were not available.

Need further assistance?

If you have additional questions related to the AES Compliance Review Program, or general AES filing questions, feel free call the Data Collection Branch at 1-800-549-0595, Option 1, or through email at <[email protected]>.