A Guide to Report Exporting Gold

Data is essential in estimating the U.S. GDP, but what happens when it is corrupted or manipulated? The consequences could be disastrous, especially for something as valuable and influential as gold. Did you know that misclassifying gold can lead to an error in the Automated Export System (AES)? So, what’s the right way to classify gold? The short answer: by its weight, shape, and purity level. In this blog, I will explain the existing primary gold classifications and common mistakes that exporters make when classifying gold.

Gold bullion is gold that’s been cast into bars or ingots that are at least 99.95% pure. Gold can be used as a store of value. A store of value means an asset that maintains its worth over an extended period. The Harmonized System (HS) Schedule B classification number 7108.12.1010 is specifically designated for bullion exports. Exporters dealing with bullion must use this code to accurately declare their shipments and comply with international trade regulations.

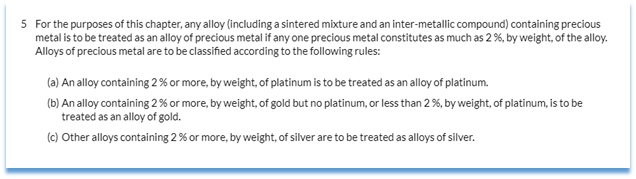

Next, we have gold dore which falls under HS Schedule B classification number 7108.12.1020. Dore is essentially a semi-pure alloyed gold typically obtained from mining operations that often contains impurities such as silver and other precious or base metal compounds. Alloyed gold can only be classified based on the General and U.S. Rules of Interpretation found in Chapter 71, Note 5 of the Schedule B. Please refer to the graphics below for further details:

The HS Schedule B classification number 7108.12.5000 encompasses a broader category of gold products. Unlike the previous classifications, this code is not intended for bullion, dore, powder or gold leaf. This category includes gold concentrate with a purity less than 99.95%, sometimes referred to as “pay dirt” or “black sands.” Black sands consist of gold concentrates that primarily contain iron. On the other hand, alluvial gold refers to gold obtained from riverbeds.

Gold powder and gold leaf are two products made from real gold but have different characteristics and uses than bullion or dore. Gold leaf is a thin sheet of gold created by hammering solid gold into a very fine layer. Gold leaf can be as thin as 0.1 microns and can have different shades and purity levels depending on the amount of pure gold and other metals in the alloy. Gold powder is made by crushing gold leaf and mixing it with molten glue. Gold leaf is classified under the HS Schedule B number 7108.13.1000 and gold powder classified under HS Schedule B number 7108.11.0000. After confirming the classification of your precious metal, you can focus on correctly entering its quantity based solely on the weight of its gold content.

Unit of Measure

The most frequent mistakes in reporting gold are using the incorrect unit of measure. This is because the unit of measure used in precious metal trading and on invoices may differ from the unit of measure required based on the HS Schedule B classification of the product. For example, grams are always the unit of measure for HS Schedule B classification numbers listed in this blog.

Quantity

As a rule, report gold using the net weight amount of gold (Au) in grams in the bar. Use whole units from the Schedule B classification code. This is the same for all gold types. A common problem in reporting gold quantity often stems from failing to convert the units of measurement for quantity, like from kilograms to grams or from ounces to grams. To help solve this issue, use an online conversion calculator.

Shipping Weight

Enter the gross shipping weight in kilograms. As noted, bullion is typically 99.9% pure, and the total weight includes the weight of the gold bar, packaging, and shipping container. The total shipping weight entered in the AES cannot be less than the net quantity.

Value (U.S. dollars)

The value field should contain the actual value of the commodity, which includes the selling price or product cost, freight cost, insurance, and other charges to the U.S. port of export. To clarify, the selling price or product cost is the actual value of the goods themselves. The cost of freight, insurance and other charges to the U.S. port of export are referred to as the Cost, Insurance, and Freight or CIF. These costs the seller covers to ensure goods arrive at the buyer’s designated port. When calculating the value, do not include discounts, commissions or cents. Round fractions of 50 cents or more up to the next dollar and ignore fractions of less than 50 cents. Our system only recognizes whole dollars. Refer to Foreign Trade Regulation 30.6 (a) (17) for more details.

Key Points to Remember

- Classification of gold depends on its weight, shape and purity level.

- Quantity is always in grams.

- Only use the net weight for the quantity.

- Shipping weight is in gross kilograms.

It’s important for gold exporters to understand the Harmonized System Schedule B classification numbers. Whether dealing with bullion, gold dore, or other unwrought forms. Using the correct HS Schedule B number ensures compliance with international trade regulations. By adhering to these classifications, exporters can streamline the export process and contribute to the growth of the global gold trade. Always consult with trade experts or customs authorities for the latest updates and guidance on gold export classifications.

Have questions? Call the Census Bureau’s International Trade Helpline at 1-800-549-0595 (select Menu Option #2) or email [email protected].