Trends in Health Insurance Premiums for Public and Private Employers

Trends in Health Insurance Premiums for Public and Private Employers

Undoubtedly, you have seen headlines or heard reports in the media comparing employee benefits between the public and private sectors. An important component of employee benefits is health insurance. In a current project, Tom Buchmueller (University of Michigan), Jessica Vistnes (Agency for Healthcare Research and Quality), and I are using data from the Medical Expenditure Panel Survey-Insurance Component (MEPS-IC) to analyze recent trends in health insurance premiums and benefits for public and private sector employers.

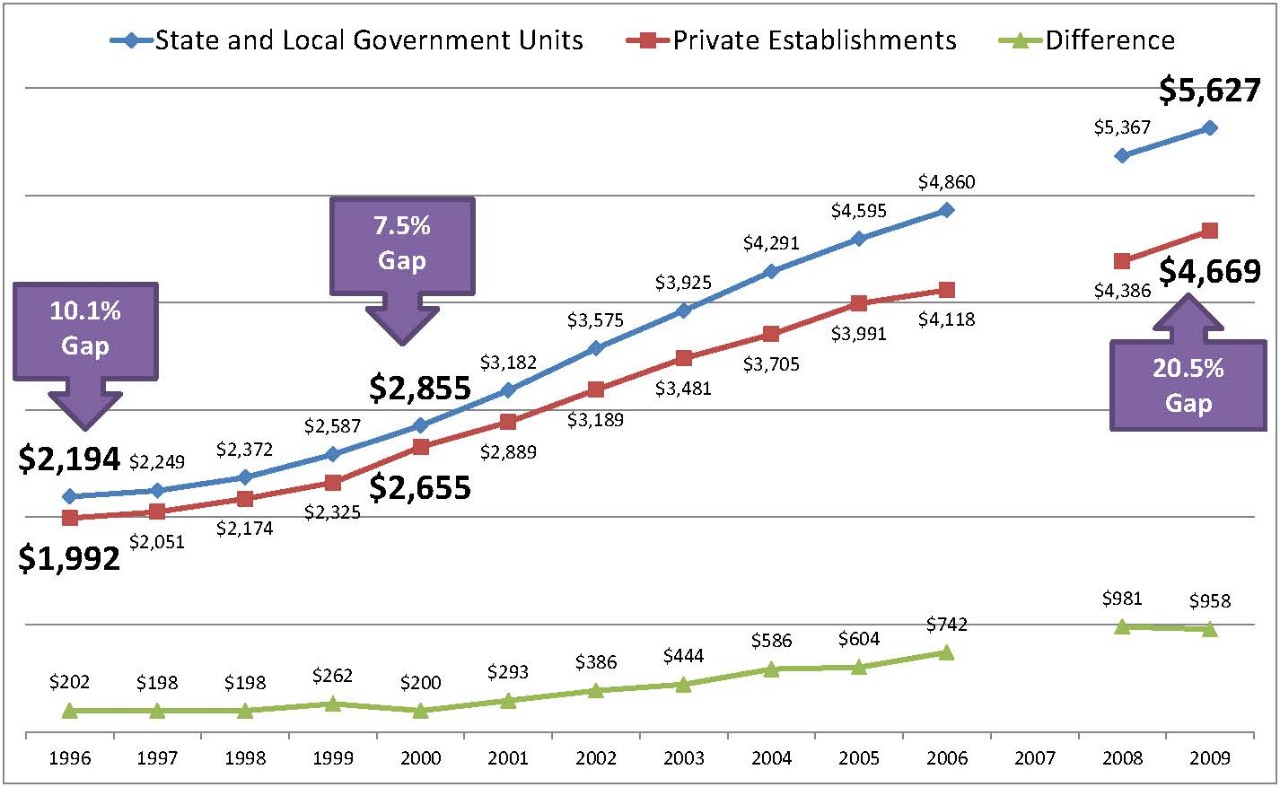

Looking at publicly available estimates based on the MEPS-IC, we found that the gap between premiums for the public sector (state and local governments) and private employers grew dramatically from 7.5 percent in 2000 to 20.5 percent just nine years later. The figure below shows this growing gap in premium costs for enrollees. In 2009, the single premium per employee enrolled in state and local government health plans was $5,627 versus $4,669 for plans offered by employers in the private sector. A more detailed analysis (not shown) indicates that the higher growth in premiums in the public sector was driven by rising premiums for local government establishments.

One possible explanation for this divergence is that private sector employers responded more to increases in health care costs and the financial pressures brought on by the Great Recession. In our ongoing work using the MEPS-IC microdata, we will examine whether private sector employers were more likely to alter benefits in order to “buy down” health insurance premiums. In particular, we will test the extent to which benefit changes can explain the growing gap illustrated in the figure. Look for future postings in the Research Matters blog with more details on our results.

Average Total Single Premium per Employee Enrolled

Source: Agency for Healthcare Research and Quality. 1996-2009 Medical Expenditure Panel Survey-Insurance Component Internet tables I.C.1. and III.C.1. //meps.ahrq.gov/mepsweb/data_stats/quick_tables_search.jsp?component=2&subcomponent=1

The Census Bureau collects the MEPS-IC under sponsorship of the Agency for Healthcare Research and Quality. The Census Bureau sponsors or co-sponsors the collection of data on health insurance in other surveys, including the American Community Survey (ACS), the Current Population Survey Annual Social and Economic Supplement (CPS ASEC), and the Survey of Income and Program Participation (SIPP). For more information, see the Census Bureau’s Health Insurance webpage.

Alice Zawacki, Senior Economist, Center for Economic Studies