Business Formation Statistics: A New Census Bureau Product that Takes the Pulse of Early-Stage U.S. Business Activity

Business Formation Statistics: A New Census Bureau Product that Takes the Pulse of Early-Stage U.S. Business Activity

Employer business startups (new firms with employees) play a key role in job creation and productivity growth in the U.S. economy.1 While most startups either fail or remain small, some grow to become large and successful firms, in the process transforming industries and the economy. Startups and young firms are also particularly sensitive to business cycles and economic conditions. For example, there was a major reduction in the number of business startups in the early phases of the Great Recession. However, this was not apparent during these early phases due to a lack of high-frequency, up-to-date data on business formation in the economy. The availability of such data can enhance our understanding of changes in new business formation when aggregate economic conditions worsen or improve. Moreover, high-frequency movements in new business formations themselves have the potential to foretell changing economic conditions, as entrepreneurs may react to early signs of such changes and reassess their business plans.

Without timely and high-frequency data on early-stages of business activity, it is impossible to know to what extent the quantity and quality of potential new employer businesses reflect impending shifts in the underlying economic fundamentals. The lack of timely, accurate and comprehensive information on business startups has prevented researchers, policy makers, and the business community from assessing recent national and local trends in business formation. The Business Formation Statistics (BFS), a new public-use data product of the U.S. Census Bureau released as a research (beta) series in February 2018, aims to address this shortcoming.

The BFS provides timely and high-frequency measures of new business applications and formations in the United States.2 The BFS contains multiple time series data on both business applications (four series) and business formations (eight series). All BFS data is available nationwide and by state, starting from the third quarter of 2004. The initial release contains data until the third quarter of 2017, with quarterly updates planned in the future.

The BFS is based on applications for Employer Identification Numbers (EINs) made through IRS Form SS-4. EIN applications are precursors of new employer businesses to potentially form in the near future, since businesses that hire employees need an EIN for payroll tax purposes. The BFS utilizes the information in EIN applications to track applications made for business purposes over time at quarterly frequency.

The characteristics of potential new businesses revealed in the EIN applications also contain valuable information on the likelihood an application will ultimately become an employer business – a job creator. Based on this information, the BFS offers forward-looking measures of actual and projected number of employer business formations that originate from quarterly applications within a given time window (four or eight quarters) from application submission. Information on business formations is summarized in eight different business formation series in the BFS.

The BFS provides four related business applications series that correspond to different types of applications based on the application characteristics. These four series are depicted in Figure 1.

Figure 1. The relationship between various business applications series in the BFS

Starting with the largest group in Figure 1, the core applications series in the BFS is Business Applications (BA). BA are EIN applications that are deemed primarily intended for business purposes based on the information in the application. Moving further in are High-Propensity Business Applications which tracks applications with a much higher likelihood of becoming employer businesses than the typical business application. This measure includes applications from corporations and selected industries, in addition to business applications with planned wages. Business Applications with Planned Wages contains those business applications that indicate an intent to pay wages. Business Applications from Corporations are business applications filed by corporations. Both of these application types exhibit relatively high rates of turning into employer businesses.

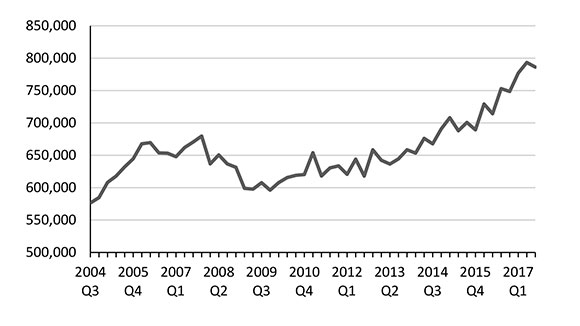

Figure 2 shows the time path for BA. Business Applications arrive at a quarterly rate exceeding 650,000 during the quarters immediately preceding the Great Recession, but this rate drops as the recession hits in the fourth quarter of 2007. The decline continues into the depths of the recession as the number of applications bottom out around 600,000 in 2009. A gradual recovery starts after 2009, and accelerates especially after 2013. By 2017, BA come in at quarterly rates that are far above the pre-recession levels.

Figure 2. Business Applications (BA), seasonally adjusted

But this is not the whole story. While BA recovers from its lows during the Great Recession, high-quality applications, which have a relatively high rate of turning into job-creating businesses, do not follow the same pattern. For example, as shown in Figure 3, Business Applications with Planned Wages exhibits a sharp decline as the recession arrives, continues to drift lower, and shows little sign of recovery. This pattern also holds more generally for the more comprehensive BFS series High-Propensity Business Applications (HBA). The time-path for HBA in Figure 4 is similar to that in Figure 3, except there is some recovery that begins in 2014 and continues.

Figure 3. Business Applications with Planned Wages (WBA), seasonally adjusted

Figure 4. High-Propensity Business Applications (HBA), seasonally adjusted

Overall, business applications that have relatively high likelihood of turning into job creators have not fully recovered after the Great Recession, and their quarterly volume is still far below its pre-recession levels. Combining Figures 2 through 4, there is recovery in the quantity but not so much in the quality of business applications, where quality is measured specifically by the probability that an application becomes a job creator in the near future.

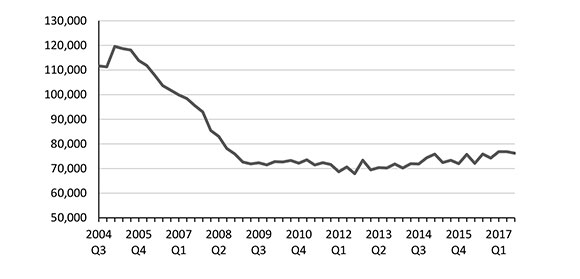

Now, consider the patterns of business formations. One of the business formation series in the BFS is Business Formations within 4 Quarters (BF4Q), which is a forward-looking measure composed of business applications that turn into businesses with payroll within four quarters of application. Plotted in Figure 5 is the actual and projected BF4Q. The series is comprised of actuals (through the last quarter of 2014) and estimates (starting in the first quarter of 2015 when actuals are not yet available). As in the case of the various business application series in Figures 2-4, BF4Q falls sharply during the Great Recession. However, the decline starts much earlier than 2007 compared to the business application series in Figures 2-4, owing, in part, to the forward-looking nature of business formations. The projections indicate a slight recovery starting in 2014, as BF4Q rise to nearly 80 thousand per quarter, after bottoming out at around 70 thousand in 2012. Nevertheless, business formations remain far below their pre-recession levels.

Figure 5. Business Formations within 4 Quarters (BF4Q) - Actual and Projected, Seasonally Adjusted

How did the individual states fare before and after the Great Recession? The heat maps in Figure 6 give snapshots of the variation in per capita Business Formations within 4 Quarters (BF4Q) across states for three years: 2006, 2010 and 2017. The maps are based on actual figures for 2006 and 2010, and projections for 2017, for which the actuals are not yet available. In the pre-recession year of 2006, most of the western states, as well as many states on the East Coast are “hot”; they perform relatively well in terms of new employer business formations per capita. However, a relative weakness in BF4Q is already noticeable in some states, including the Midwest. In 2010, three years after the onset of the Great Recession, business formations per capita have fallen substantially for many states.

Projected business formations per capita based on 2017 business applications indicate that there has been little improvement overall since 2010. Many states are projected to create new employer businesses at much lower rates than the pre-recession levels in 2006. The time series data for individual states available in the BFS suggest that there has been little recovery in BF4Q for many states following the Great Recession.

Figure 6. Business Formations within 4 Quarters (BF4Q) by State - Per 1,000 People

The new high-frequency data on business applications and formations in the BFS will help researchers, policy makers and the business community monitor changes in the climate for employer business startups in a timely fashion. The data also opens new possibilities for research on a variety of topics in entrepreneurship, including, but not limited to, the dynamics of entrepreneurial activity, the relationship between business cycles and new business formation, and the effects of local economic development policies on new business activity.

1See, Haltiwanger, John, Ron Jarmin and Javier Miranda. 2013. "Who Creates Jobs? Small versus Large versus Young", Review of Economics and Statistics, 95(2): 347-361.

2 For further details on the BFS and to access data, visit www.census.gov/programs-surveys/bfs.html.