Racial and Ethnic Disparity in Homeownership Continues Even Among Highly Educated

Before the 2007-2009 Great Recession, homeownership among households headed by adults ages 25-34 spiked as risky lending practices greatly expanded access to mortgage credit. Soon after, the nation experienced a housing market crash and economic downturn.

Since then, lending options tightened and home prices soared. This limited young householders’ ability to own a home, driving down ownership rates which had yet to return to pre-recession levels by 2019.

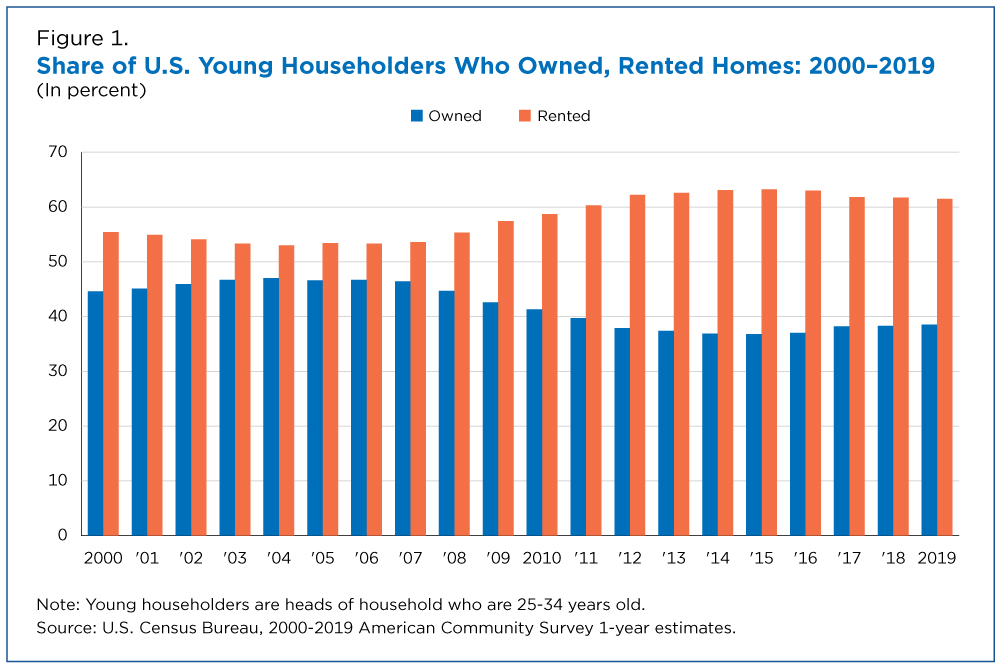

Homeownership among households headed by adults ages 25 to 34 was highest from 2003 to 2007. Rates for those years, just prior to the Great Recession, ranged from 46.4% to 47.0%, according to data from the 2000-2019 American Community Survey (ACS) 1-year estimates.

The lowest rates of homeownership among young householders occurred between 2014 and 2016. They saw a slight increase after that, but not to their high pre-recession levels.

By 2010, right after the recession ended, homeownership among young heads of household had declined to 41.3% and continued to decline to 36.8% in 2015.

The impact on the housing market of the COVID-19 pandemic, which began in 2020, is not captured in this dataset.

What Changed?

Following the Great Recession, the financial landscape and opportunities for young adults to become homeowners shifted.

Stricter lending practices and credit standards made it difficult for young adults without a stable employment history and financial resources to buy a home.

At the same time, especially in the latter half of the most recent decade, home prices rose substantially, creating another barrier to homeownership for young buyers.

Young adults at the time were also delaying major life events such as forming their own households and getting married, typical precursors to homeownership.

Homeownership Before and After the Great Recession

Homeownership among young householders peaked in the years prior to the 2007-2009 Great Recession (Figure 1) but plunged almost 10.0 percentage points from 2007 to 2015.

The lowest rates of homeownership among young householders occurred between 2014 and 2016. They saw a slight increase after that, but not to their high pre-recession levels.

Education and Homeownership

Higher levels of educational attainment are typically associated with greater economic stability, employment and full-time work, and lower levels with lower incomes and greater economic hardship.

The economic effects of higher educational attainment also tend to protect individuals during economic downturns.

According to ACS data, homeownership rates among young householders differed by educational attainment. This is largely because higher education usually results in higher earnings critical for obtaining home loans and purchasing first homes.

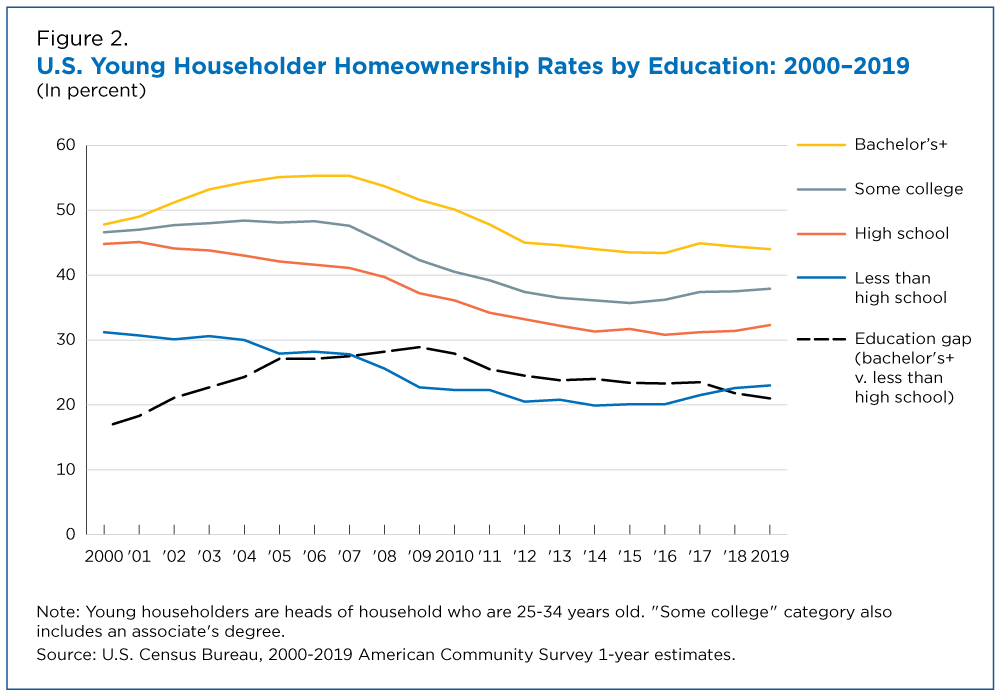

We reviewed estimates of homeownership rates between 2000 and 2019 among young householders by four education categories: less than a high school degree; high school degree but no college; some college or an associate degree; and a bachelor’s degree or higher (Figure 2).

In 2000, homeownership rates were most similar among householders with a bachelor’s degree or higher (47.8%), some college (46.6%), and a high school degree (44.8%). But the rate for householders with less than a high school education was approximately one-third lower than the other educational categories (31.2%).

Homeownership rates have been stratified by educational attainment throughout the first decade of the 21st century.

The rates for householders with a bachelor’s degree or at least some college peaked just before the Great Recession.

Rates for householders with at least a bachelor’s degree were highest (between 54.3% and 55.3%) from 2004 to 2007, and for householders with some college (between 46.6% and 48.3%) from 2000 to 2006. Meanwhile, rates for householders with a high school degree or less declined through the first decade of the 21st century.

Post-recession homeownership rates were lower than pre-recession rates for all education groups, but there were significant differences between education groups.

The decline in homeownership halted between:

- 2012 and 2016 for householders with less than a high school education (19.9% to 20.8%).

- 2016 and 2018 for those with a high school degree (30.8% to 31.4%).

- 2013 and 2016 for those with some college (35.7% to 36.5%).

- 2015 and 2016 for those with a bachelor’s degree or higher (43.4% to 43.5%).

In 2019, young householders with a bachelor’s degree or higher had the highest homeownership rate (44.0%), followed by those with some college (37.9%), a high school degree (32.3%), and less than high school (23.0%).

Homeownership rates decreased for all education levels among young householders after the recession and were still below pre-recession level highs in 2019.

The education gap in homeownership – the difference between householders with less than a high school education and those with a bachelor’s degree or higher – still existed but narrowed after the recession.

The education gap in young household homeownership was 16.6 percentage points in 2000. It increased before and during the recession, plateauing at 28.9 percentage points in 2009. It declined to 21.0 percentage points in 2019.

Rise in Diversity

The nation’s young population has become increasingly diverse during the past two decades. Both younger and non-White households have historically had lower homeownership rates than older and White households.

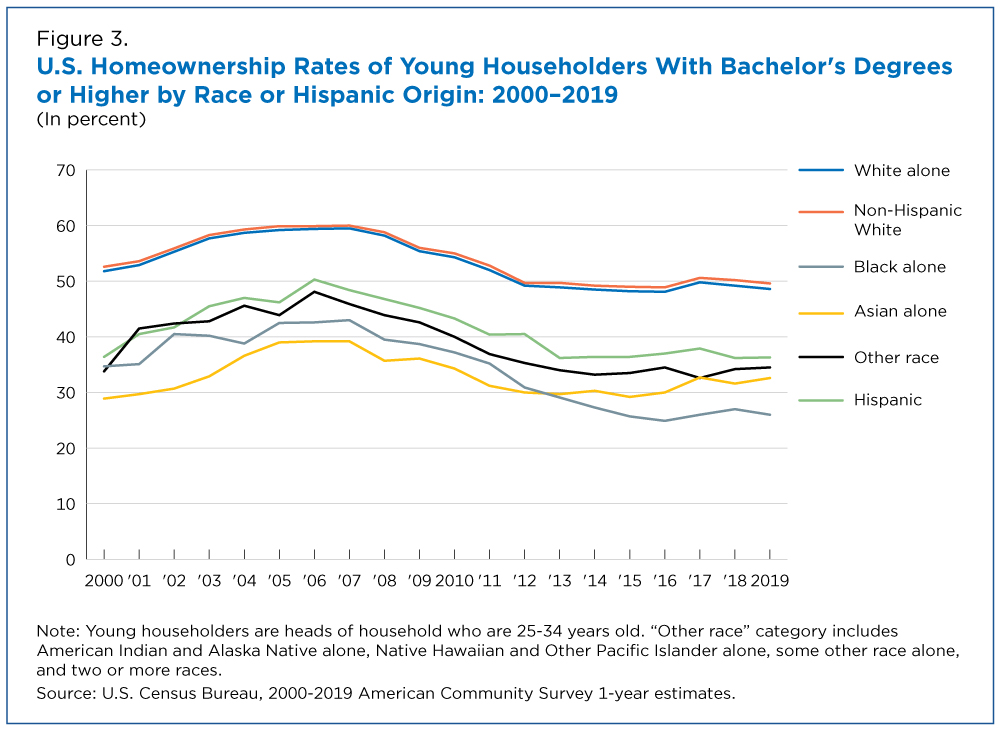

One might expect higher education to reduce differences in homeownership by race and Hispanic origin. However, there are substantial differences even among this most highly educated group.

For example, highly educated young Black householders experienced the greatest post-recession declines in homeownership, while young and highly educated Asian householders experienced the smallest declines (Figure 3).

In 2000, over half of young householders with a bachelor’s degree or higher identifying as White alone (51.8%) or non-Hispanic White (52.6%) owned homes.

In contrast, just over a third of similarly educated Hispanic (36.4%) and Black alone young householders (34.7%) owned homes. Young householders with a bachelor’s degree or higher identifying as Asian alone – who experienced the smallest declines after the recession – had the lowest rates of homeownership (28.9%).

Young household homeownership rates among the more educated peaked just before or in the early days of the Great Recession for each race category and Hispanic origin.

Peak rates of homeownership for non-Hispanic White and White alone young householders with a bachelor’s degree or higher were 59.3% to 60.0% and 57.7%-59.5%, respectively, followed by young Hispanic householders (50.3%), Other race (48.1%), Black alone (42.5%-43.0%), and Asian alone (39.0%-39.2%).

In 2019, only Hispanic homeownership rates had returned to their 2000 rates among more educated young householders, and no analyzed racial category had returned to the elevated homeownership rates experienced just before the recession. Less than half of young householders with a bachelor’s degree or higher identifying as White alone (48.6%) or non-Hispanic White (49.6%) owned homes.

In contrast, roughly one-third of similarly educated Hispanic (36.3%) and Asian alone young householders (32.6%) owned homes. Young householders with a bachelor’s degree or higher identifying as Black alone – who experienced the largest declines after the recession – had the lowest rates of homeownership (26.0%).

As the nation moves through this decade and experiences its economic challenges, we will continue to analyze the effects of educational attainment and diversity on homeownership among young householders.

Related Statistics

-

Stats for StoriesAmerican Housing Month: June 2023The 2021 American Community Survey counted 142.15M housing units, up 3.61M from 2018, and up 10.36M from 131.79M in 2010.

-

American Community Survey (ACS)The American Community Survey is the premier source for information about America's changing population, housing and workforce.

Subscribe

Our email newsletter is sent out on the day we publish a story. Get an alert directly in your inbox to read, share and blog about our newest stories.

Contact our Public Information Office for media inquiries or interviews.

-

America Counts StoryHousing Vacancy Rates Near Historic LowsMay 12, 2022Housing Vacancy Survey shows that availability of homeowner and rental housing tightened during the COVID-19 pandemic.

-

America Counts StoryZillow and Census Bureau Data Show Pandemic’s Impact on Housing MarketOctober 04, 2021The housing market stalled in spring 2020 but rebounded by summer.

-

EmploymentThe Stories Behind Census Numbers in 2025December 22, 2025A year-end review of America Counts stories on everything from families and housing to business and income.

-

Families and Living ArrangementsMore First-Time Moms Live With an Unmarried PartnerDecember 16, 2025About a quarter of all first-time mothers were cohabiting at the time of childbirth in the early 2020s. College-educated moms were more likely to be married.

-

Business and EconomyState Governments Parlay Sports Betting Into Tax WindfallDecember 10, 2025Total state-level sports betting tax revenues has increased 382% since the third quarter of 2021, when data collection began.

-

EmploymentU.S. Workforce is Aging, Especially in Some FirmsDecember 02, 2025Firms in sectors like utilities and manufacturing and states like Maine are more likely to have a high share of workers over age 55.