Lessors of Mini Warehouses and Self-Storage Units Show Significant Financial Gains During COVID-19 Pandemic

The self-storage industry has demonstrated unique resilience to economic downturns, including the financial impact of the COVID-19 pandemic, according to U.S. Census Bureau data.

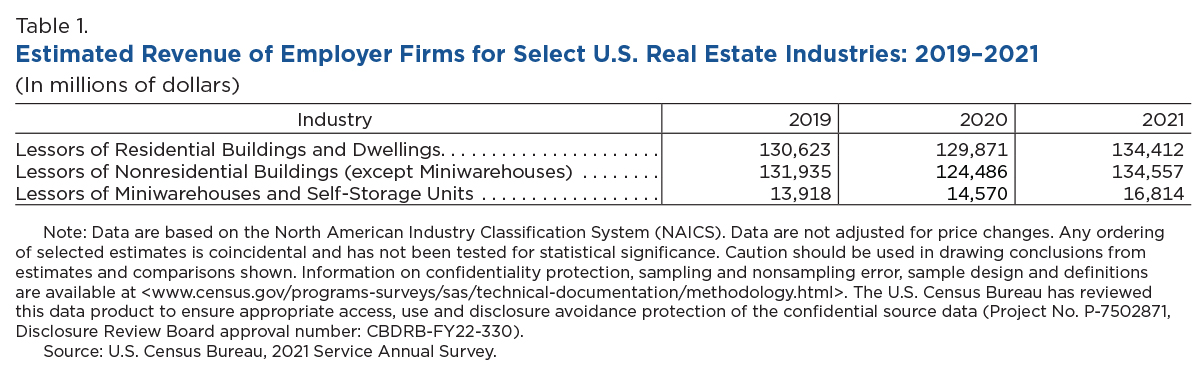

Census Bureau’s latest Service Annual Survey (SAS) shows increasing revenue trends from 2019 to 2021 for Lessors of Miniwarehouses and Self-Storage Units.

A report suggests that self-storage may have benefited during the pandemic from people needing more storage as they relocated or made room for home offices to work remotely.

Lessors of Nonresidential Buildings (except Miniwarehouses) experienced a downward trend of -5.6% from 2019 to 2020 but rebounded in 2021. Lessors of Residential Buildings and Dwellings saw a change of -0.6% from 2019 to 2020 (this change is not statistically significant based on a 90% confidence interval) and also rebounded in 2021.

Changes in Living and Working Environments

Self-storage units are a service that can be used by those planning a change in residence, downsizing or in need of more storage space.

A report suggests that self-storage may have benefited during the pandemic from people needing more storage as they relocated or made room for home offices to work remotely. According to the 2021 American Community Survey (ACS), the percentage of people working from home nearly tripled from 5.7% in 2019 to 17.9% in 2021.

In addition to telework flexibilities, some people relocated, including 32% of millennials and Generation Zers who moved back in with their parents during the pandemic, according to one survey.

As of March 2023, Worldwide ERC, a relocation services trade group, reports commercial office space usage was 50% of pre-pandemic averages. Since the pandemic began in 2020, more businesses have been opting for a hybrid or remote work environment which may create an increased need for mini-warehouses to store unused equipment and furniture.

More Evidence of Self-Storage Industry’s Resilience

The self-storage industry’s ability to withstand economic downturns has also been evident in data from the National Association of Real Estate Investment Trusts (NAREIT). A REIT is a company that, in addition to meeting certain shareholder and investment requirements, owns, operates or finances income-producing real estate, such as self-storage units.

In 2008, amid the Great Recession, most REITs suffered losses, but self-storage showed a positive 5% return, according to NAREIT.

Occupancy rates provide more evidence of the industry’s resilience. According to S&P Global Market Intelligence, self-storage occupancy averaged 96.5% in the third quarter of 2021 compared to 91.5% in the first quarter of 2020.

Low Operating Costs and Flexible Leases

Some other factors that may have benefited the self-storage industry during the pandemic are:

- Minimal face-to-face interactions. The industry has embraced new technology including online renting, self-service kiosks and smart-entry cloud-based technology.

- Low operating costs. Self-storage units have relatively simple building structures with fewer maintenance needs than other commercial real estate.

- Short-term leases. Operating on short-term leases can be beneficial during unstable economic conditions because it allows owners to adjust rental rates more frequently.

More SAS Data

The latest 2021 SAS includes estimates and accompanying measures of sampling variability and sheds some light on additional industries, like those outlined in this article.

Subscribe

Our email newsletter is sent out on the day we publish a story. Get an alert directly in your inbox to read, share and blog about our newest stories.

Contact our Public Information Office for media inquiries or interviews.

-

EmploymentSharp Drop in On-Site/In-Person Work Since 2019June 27, 2023New Census Bureau data show detailed trends in home-based work, including the rise in mixed or hybrid work.

-

Business and EconomyTracking Supply Disruptions, Impact of Inflation on Small BusinessOctober 05, 2023Bi-weekly Business Trends and Outlook Survey shows a drop in supply chain delays after the peak of the pandemic emergency but higher prices due to inflation.

-

Business and EconomyImpact of COVID-19 on Passenger and Freight TransportationSeptember 27, 2023Unlike freight transportation industries, estimated revenues for industries supporting passenger transportation saw no increases from 2019 to 2020.

-

IncomeHow Income Varies by Race and GeographyJanuary 29, 2026Median income of non-Hispanic White households declined in five states over the past 15 years: Alaska, Connecticut, Louisiana, Nevada, and New Mexico.

-

HousingRental Costs Up, Mortgages Stayed FlatJanuary 29, 2026Newly Released American Community Survey compares 2020-2024 and 2015-2019 housing costs by county.

-

HousingShare of Owner-Occupied, Mortgage-Free Homes Up in 2024January 29, 2026The share of U.S. homeowners without a mortgage was higher in 2024 than a decade earlier nationwide and in every state, though not all counties saw increases.

-

PopulationU.S. Population Growth Slowest Since COVID-19 PandemicJanuary 27, 2026The decline in international migration was felt across the states, though its impact varied.