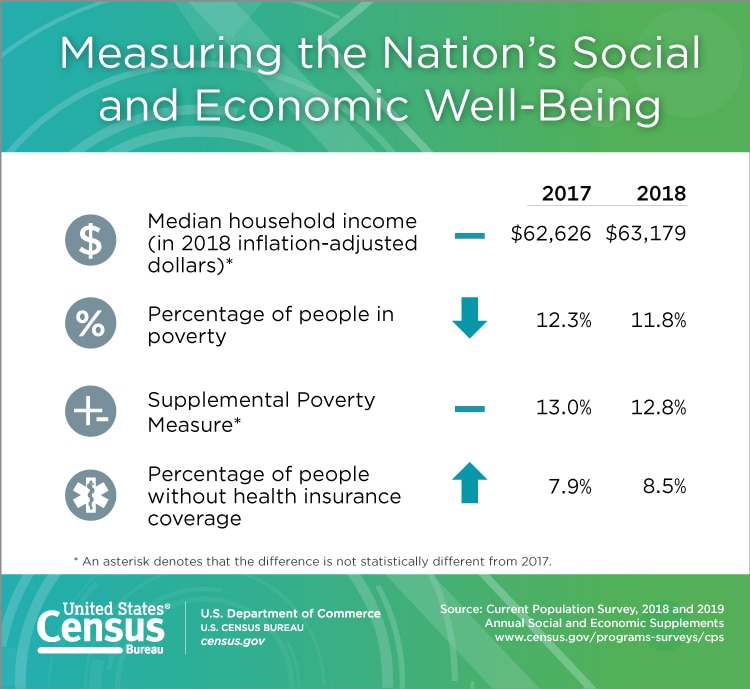

Measuring the Nation's Social and Economic Well-Being

Measuring the Nation's Social and Economic Well-Being

Erratum Note:

Oct. 11, 2019 - Due to an error in our tax model, tax units with an Adjusted Gross Income (AGI) below $12,000 were inadvertently not run through the Additional Child Tax Credit (ACTC) portion of the tax model. As a result, 2,435 tax units did not receive this refundable credit, which changed the Supplemental Poverty Measure (SPM) poverty status of about 600 individuals (or 0.3% of the weighted population). This error changed our top-level SPM estimate from 13.1% for 2018 to 12.8%. Using either set of estimates, the change between 2017 and 2018 was not significant overall or for any of the major age categories. All SPM estimates have been revised accordingly.

Download or Print this Graphic:

Sources and Reference

Current Population Survey, 2018 and 2019

Annual Social and Economic Supplements

www.census.gov/programs-surveys/cps.html

Page Last Revised - January 27, 2022