National Tax Day: April 18, 2023*

National Tax Day: April 18, 2023*

*From the IRS, News Releases, IR-2023-11, January 23, 2023:

“WASHINGTON — The Internal Revenue Service kicked off the 2023 tax filing season with a focus on improving service and a reminder to taxpayers to file electronically with direct deposit to speed refunds and avoid delays.

“Following a successful opening of its systems today, the IRS is now accepting and processing 2022 tax returns. Most of the individual tax returns for the 2022 tax year are expected to be filed before the April 18 tax deadline.

“Taxpayers have until April 18 to file their taxes this year, but some taxpayers living overseas and disaster victims may have later filing deadlines. Alabama, California and Georgia storm victims now have until May 15 to file various federal individual and business tax returns and make tax payments…

“April 18 tax deadline: This year, the filing deadline is April 18 for most taxpayers, but automatic six-month extensions of time to file are available for anyone for free. See Extension of Time to File Your Tax Return for instructions. Taxpayers should be aware that filing Form 4868 only extends the time to file tax returns. Those who owe taxes should still pay by April 18 to avoid late payment penalties.”

Key Stats

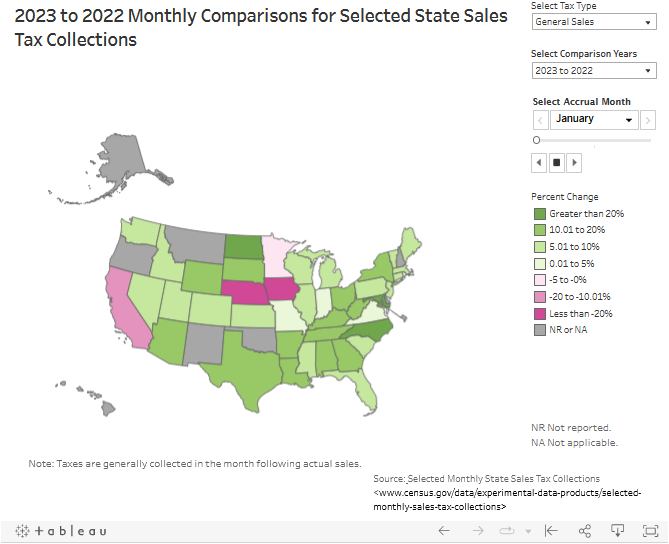

Source: Census.gov / Data / Experimental Data Products.

Note: Click on the image above to open the full interactive visualization.

More Stats

From Topics / Public Sector:

Federal, State, & Local Governments Tax Statistics:

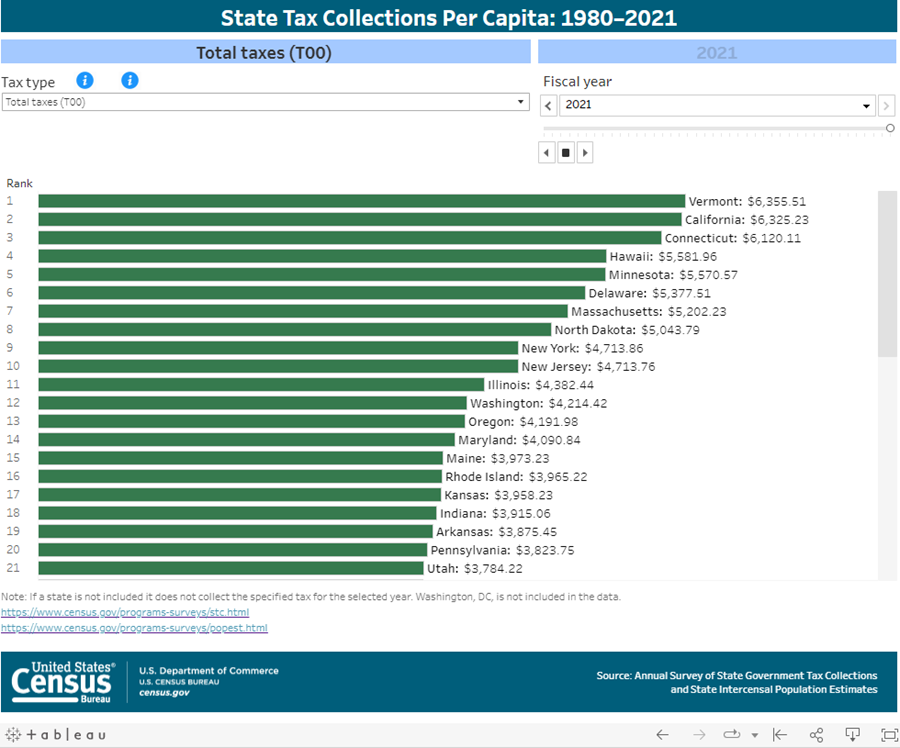

Source: Quarterly Services Survey (QSS), 2023 back to 2003.

Note: The Annual Survey of State Government Tax Collections provides a summary of taxes collected by the 50 state governments, as well as all dependent state-level governmental entities, for five broad tax categories and up to 25 tax subcategories.