Cost of Rent and Utilities Rose Faster Than Home Values in 2023

The real median gross cost of renting — rent plus the average monthly cost of utilities and fuels adjusted for inflation — grew faster annually (3.8%) than real median home values (1.8%) in 2023 for the first time in 10 years, according to the 2023 American Community Survey (ACS) released today.

This marked the largest annual real increase in rental costs since at least 2011.

The fact that the gross rent share of income did not rise nationally and in most states despite significant increases in rental costs could be due to higher renters’ incomes or to an increase in higher-income households joining the population of renters.

Every year from 2011 to 2019, real rent costs increased less than 3.0%. In 2022, after the peak of the COVID-19 pandemic, rent grew 1.0% — only one-fourth of the 2023 increase (Table 1).

Despite this large spike, the share of renter income spent on rent and utilities remained at 31.0% in 2023, an indication that renter household incomes kept pace with rent hikes.

Rent Costs by State

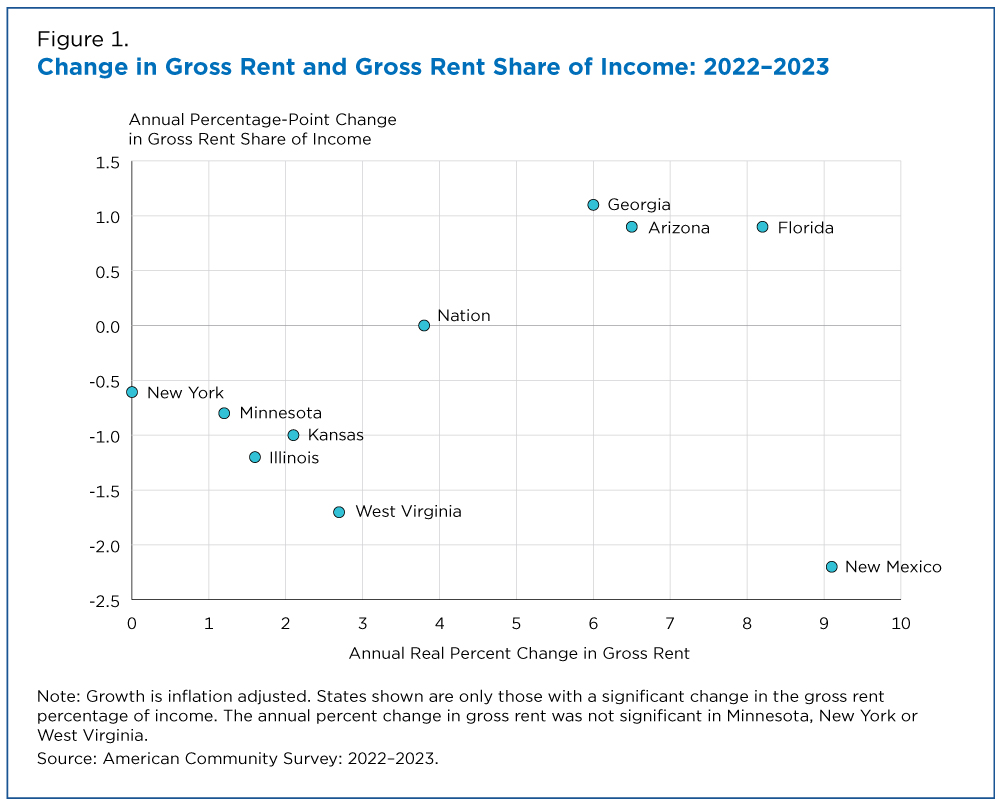

Most states saw no significant change in the ratio of gross rent to renters’ income (Figure 1).

Six states saw a decline in the share of renters’ incomes going to rent: Illinois, Kansas, Minnesota, New Mexico, New York and West Virginia.

Even as the rent share of income declined, rent increased by 1.6% in Illinois and 2.1% in Kansas (these growth rates were not significantly different), and by 9.1% in New Mexico.

In contrast, three states experienced a significant increase in the share of renters’ incomes going to rent in 2023: Arizona, Florida and Georgia.

Rents increased 6.5% in Arizona, 8.2% in Florida, and 6.0% in Georgia (Arizona rent growth was not significantly different from growth in Florida or Georgia).

Incomes Keeping Up With Rent Increases

The fact that the gross rent share of income did not rise nationally and in most states despite significant increases in rental costs could be due to higher renters’ incomes or to an increase in higher-income households joining the population of renters.

From 2022 to 2023, the number of renters grew, while median household income was not significantly different. However, this measure includes the income growth of nonrenters, and the income growth of renters and nonrenters may have differed.

The number of renter-occupied housing units increased by 0.9% in 2023. While changes to the cost of owning a home, such as higher interest rates or home values, could push households away from home ownership and toward renting, the share of households renting remained constant at 34.8% between 2022 and 2023.

Related Statistics

Subscribe

Our email newsletter is sent out on the day we publish a story. Get an alert directly in your inbox to read, share and blog about our newest stories.

Contact our Public Information Office for media inquiries or interviews.

-

Health InsuranceHealth Coverage for Working-Age Adults Rose in Every State Since 2013September 12, 2024A brief, infographic and working paper from the American Community Survey estimates out today show changes in health coverage rates by age and state 2013-2023.

-

Income and PovertyOlder Adults and Child Poverty Rates Changed in Many States in 2023September 12, 2024American Community Survey data released today show that despite a decline in child poverty rates in 2023, they remain higher than other age groups.

-

HousingLow-Income Renters Spent Larger Share of Income on Rent in 2021March 02, 2023The percentage of household income spent on rent plus utilities increased from 2019 to 2021 and renters with the lowest annual income saw the largest spikes.

-

EmploymentUnexpected Workforce Trends in Post-Pandemic ManhattanFebruary 19, 2026Recent jobs data show Manhattan’s workforce shares have shifted younger, more female and into the Accommodation and Food Services industries after the pandemic.

-

Business and EconomyAbility to Borrow Money Offers Clues to Financial Health of BusinessesFebruary 10, 2026Most employer businesses that applied for credit got what they asked for, according to the latest available data from the Annual Business Survey.

-

IncomeHow Income Varies by Race and GeographyJanuary 29, 2026Median income of non-Hispanic White households declined in five states over the past 15 years: Alaska, Connecticut, Louisiana, Nevada, and New Mexico.

-

HousingRental Costs Up, Mortgages Stayed FlatJanuary 29, 2026Newly Released American Community Survey compares 2020-2024 and 2015-2019 housing costs by county.