Most Employer Businesses’ Credit Applications in 2023 Were Approved

In the business world, applying for credit and getting it speaks volumes about a company’s financial strength.

Borrowing allows firms to expand, cover cash-flow gaps and invest in growth. And when a company’s credit application is approved, it signals solid financial footing and operating health.

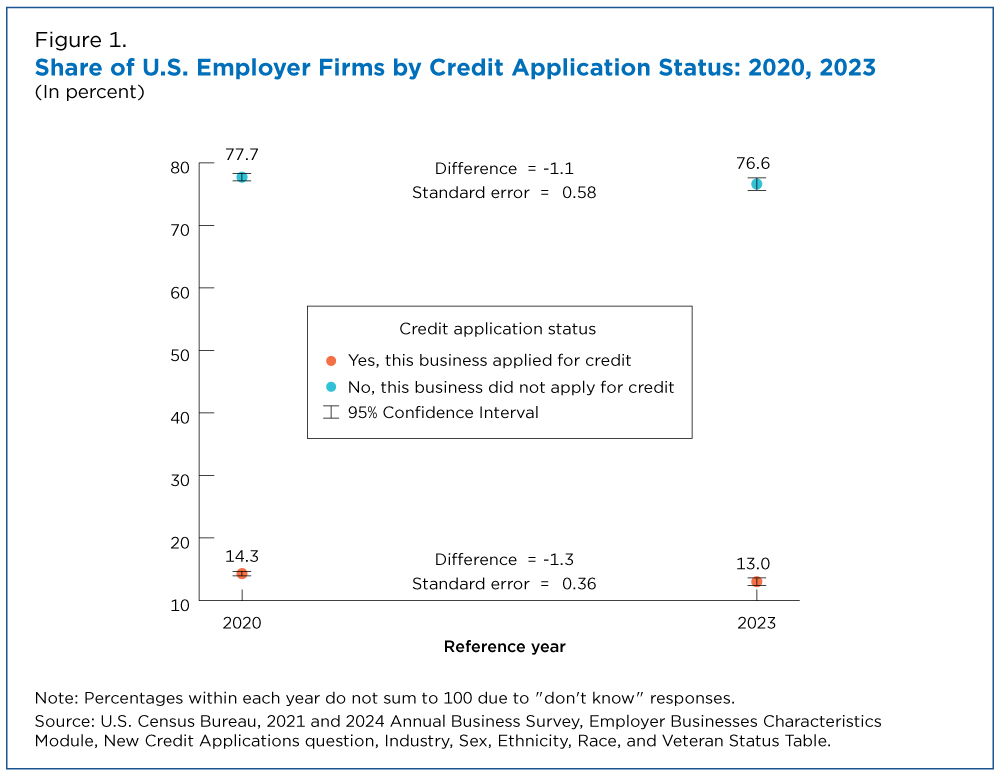

The U.S. Census Bureau’s latest Annual Business Survey (ABS), which asks employer businesses (those with paid employees) whether they applied for new credit in the previous year, shows a statistically significant 1.3 percentage-point change in the share of employer firms that reported applying for new credit from 2020 (14.3%) to 2023 (13.0%).

Whether businesses get a portion or all the credit they apply for or are denied is a direct indicator of their economic strength.

Delving deeper into the credit landscape over a three-year period — from the amount of debt companies took on to who the lenders were — paints a clearer picture of companies’ financial well-being.

We reviewed the latest data on credit sources, how many businesses received what they asked to borrow and how businesses rated their financial health.

All comparative statements underwent statistical testing and statistical significance is at the 95% confidence level.

How Many Applied for Credit and Got It?

Whether businesses get a portion or all the credit they apply for or are denied is a direct indicator of their economic strength.

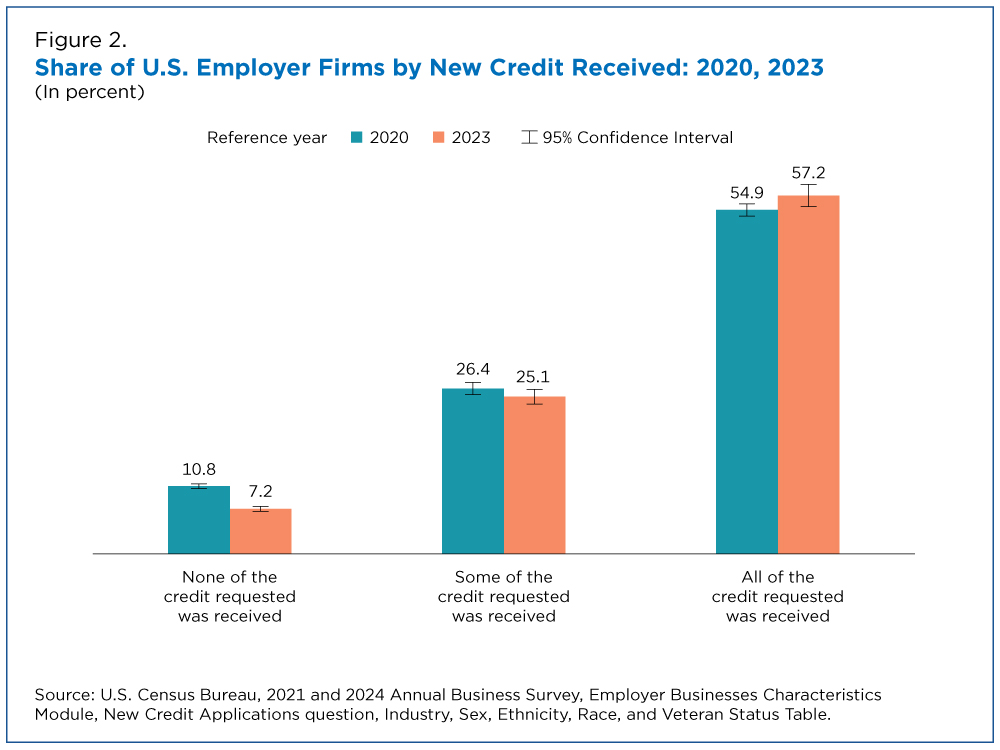

Most employer businesses (57.2%) received all the credit they applied for in 2023, up from 54.9% three years earlier.

About a quarter (25.1%) received some of the credit they asked for in 2023, not statistically different than the 26.4% approved for a portion of the requested amount in 2020.

The least likely outcome for employer businesses that applied for new credit was to receive none of the credit requested: 7.2% in 2023, down from 10.8% in 2020.

These results suggest that employer businesses were, on average, in strong enough financial shape to secure credit and increasingly likely to receive the entire amount requested.

Where Businesses Go for New Credit

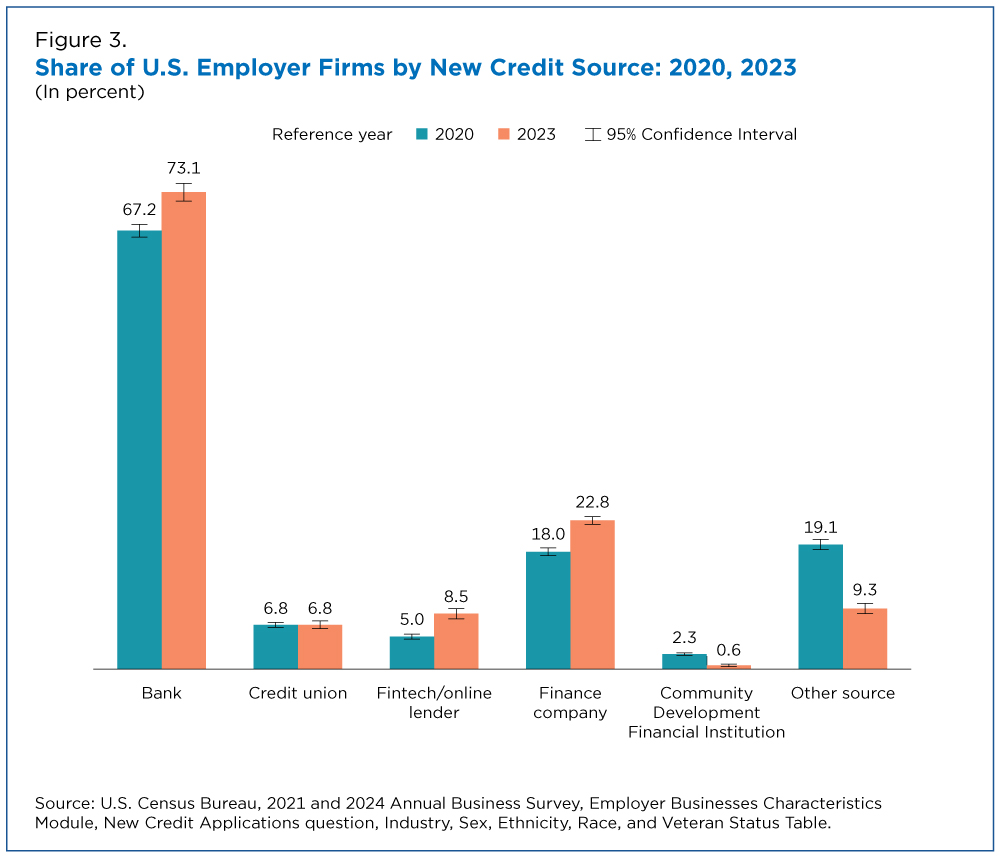

Banks were the primary source credit among employer businesses that did apply for new credit — and they became even more dominant over time. In 2023, 73.1% of employer businesses sought new credit from a bank, up from 67.2% in 2020.

Finance companies were the second most common source of new credit — 22.8% of employer businesses seeking credit in 2023 turned to them, up from 18.0% in 2020.

“Other sources” included basically any lender besides banks, credit unions, fintech (online lenders that automate underwriting and digital loan delivery), finance companies and community development financial institutions. They were the second most common option in 2020 (19.1%) but by 2023 had slipped to a 9.3% share of employer business credit applicants.

It’s important to note these percentages do not add up to 100% because an employer business may apply to more than one source of new credit.

How Businesses Rated Their Financial Health

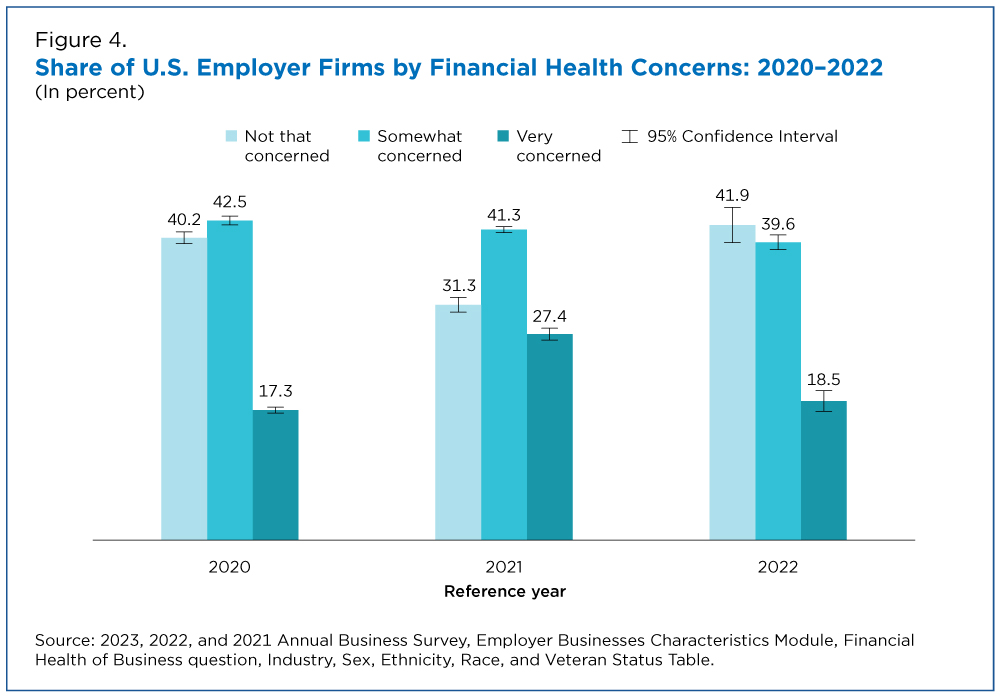

The ABS module asked employer businesses how concerned (not at all, very or somewhat) they were about their financial health in three consecutive years from 2020 to 2022. The results:

- Not concerned at all. A 40.2% share of respondents in 2020, 31.3% in 2021 and 41.9% in 2022 checked this option. This seesaw pattern suggests a temporary worsening in perceived financial health in 2021, followed by a recovery in 2022. The difference between the 2020 and 2022 levels was not statistically significant.

- Very concerned. Some 17.3% of employer businesses in 2020, 27.4% in 2021 and 18.5% in 2022 responded this way. The 10-percentage-point jump from 2020 to 2021 and the subsequent nine-point drop from 2021 to 2022 were both statistically significant. Yet again, the difference between 2020 to 2022 was not statistically significant.

- Somewhat concerned. By contrast, the share in this category declined from 42.5% in 2020 to 41.3% in 2021 and 39.6% in 2022.

How in Debt Are Businesses?

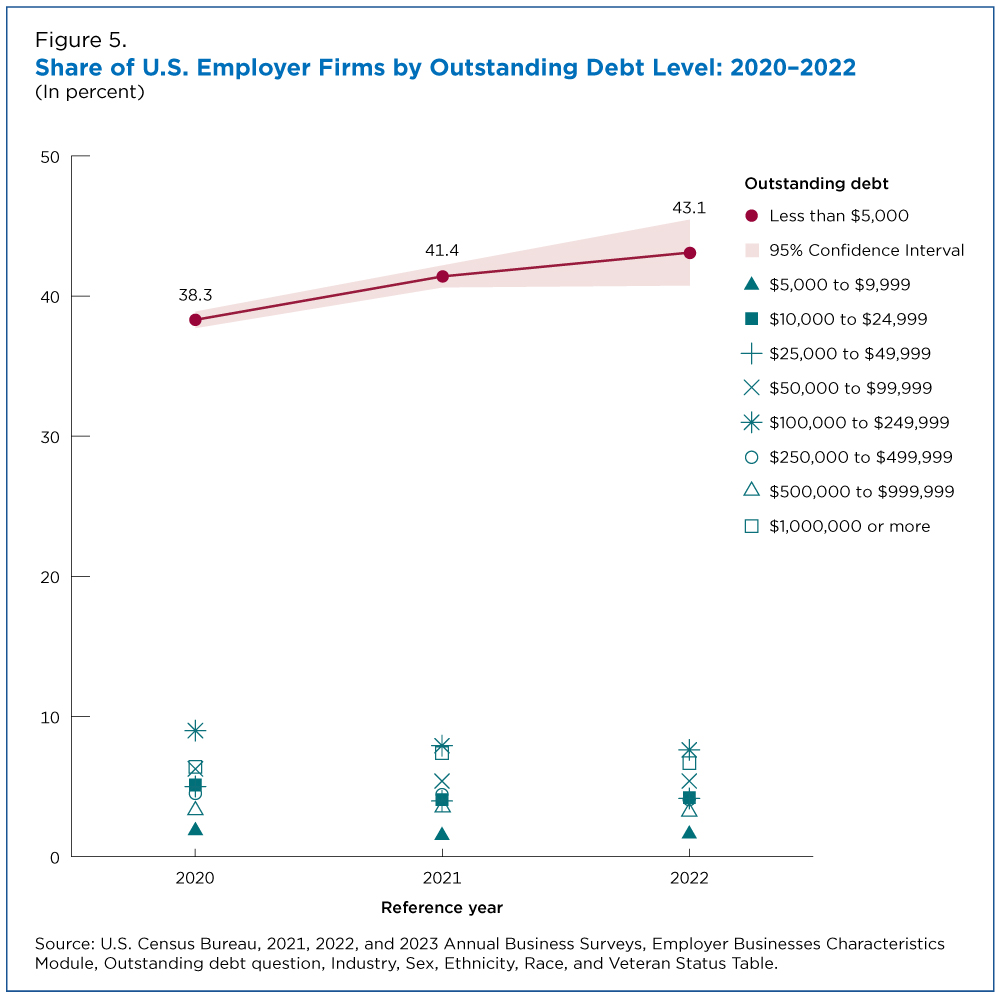

The ABS also provides details on the amount of outstanding debt employer businesses were carrying over the 2020–2022 period.

A category showing a statistically significant change during this period was at the very low end of the debt distribution: the share of employer businesses with less than $5,000 in outstanding debt rose 4.8 percentage points to 43.1%.

In short, while perceptions of financial health worsened in 2021 before rebounding, employer businesses’ debt structures were steadier, with most not carrying much higher debt and a modest shift toward lower debt balances.

Related Statistics

Subscribe

Our email newsletter is sent out on the day we publish a story. Get an alert directly in your inbox to read, share and blog about our newest stories.

Contact our Public Information Office for media inquiries or interviews.

-

Small BusinessTelling the Story of the Nation’s Smallest BusinessesMay 06, 2025The Census Bureau’s Nonemployer Statistics provide data on the nation’s 29.8 million smallest businesses without paid employees.

-

Business and EconomyRevenue and Employment Trends Reveal Shifts in U.S. EconomyDecember 30, 2025Revenue and employment losses in select retail industries continued, while online sales brokers and local delivery boomed.

-

Business and EconomyA Snapshot of Business Growth by County and IndustryOctober 30, 2024A new data visualization from the 2022 County Business Patterns shows the business landscape over 19 economic sectors in the United States and Puerto Rico.

-

Business and EconomyAbility to Borrow Money Offers Clues to Financial Health of BusinessesFebruary 10, 2026Most employer businesses that applied for credit got what they asked for, according to the latest available data from the Annual Business Survey.

-

IncomeHow Income Varies by Race and GeographyJanuary 29, 2026Median income of non-Hispanic White households declined in five states over the past 15 years: Alaska, Connecticut, Louisiana, Nevada, and New Mexico.

-

HousingRental Costs Up, Mortgages Stayed FlatJanuary 29, 2026Newly Released American Community Survey compares 2020-2024 and 2015-2019 housing costs by county.

-

HousingShare of Owner-Occupied, Mortgage-Free Homes Up in 2024January 29, 2026The share of U.S. homeowners without a mortgage was higher in 2024 than a decade earlier nationwide and in every state, though not all counties saw increases.