Renters in 20% of U.S. Counties Paid More in 2020-2024 Than in Previous Five Years

Homeowners’ costs remained nearly unchanged from 2020-2024 compared to the previous five-year period while renters paid $100 more a month to a median $1,413, according to the 2020–2024 American Community Survey (ACS) 5-year estimates released today.

The newly released data shows how housing costs changed in each of the nation’s 3,144 counties between two five-year periods – 2015-2019 and 2020-2024.

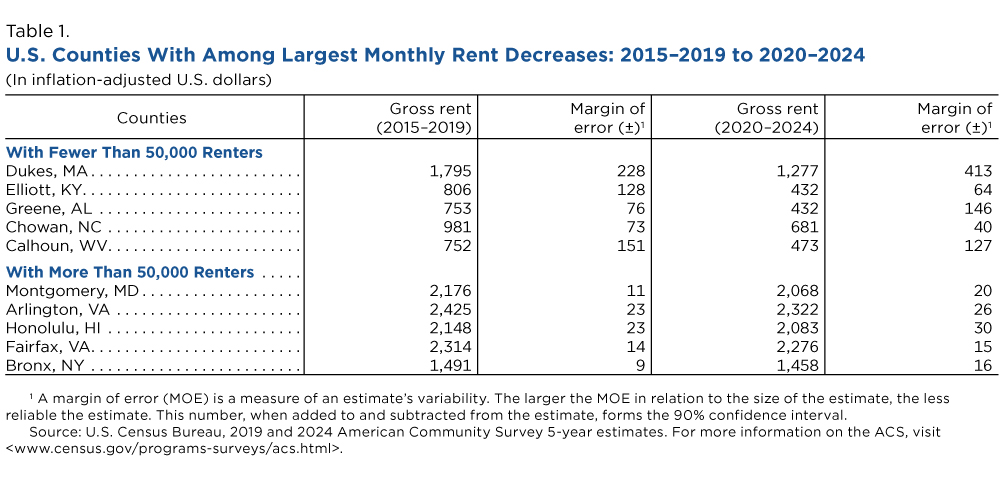

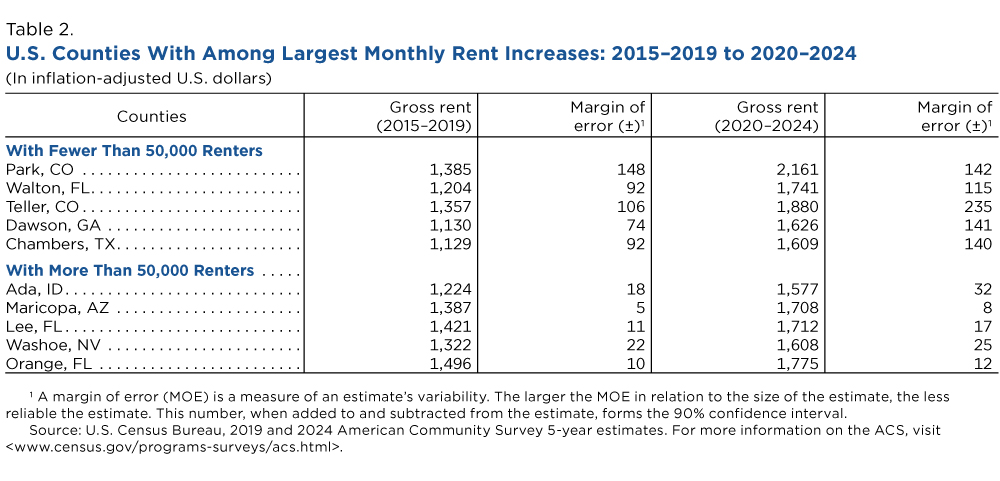

Monthly rental costs did decrease in some counties between 2015-2019 and 2020-2024, but they increased in nearly twice as many counties — including some already near or above the $1,309 national median during the earlier period.

Median gross rent (rent plus utilities) increased in 626 counties and decreased in 330 between the periods, according to the U.S. Census Bureau’s Comparison Profile (CP) tables.

The CP is a fast and easy way to see how housing costs shifted in your state, county or town. CP tables are only published for areas with more than 5,000 people and geographies with stable boundaries, which means data is available for over 2,800 counties.

They show estimates over time, including if they are statistically different from previous years. The estimates are adjusted for inflation, ensuring real-dollar comparisons.

Data on smaller towns and areas with geographic updates (like Connecticut’s change from counties to planning regions) are available through the 1-year or 5-year detailed tables or the Application Programming Interface (API).

Rents Rise for Many but Not All

Monthly rental costs did decrease in some counties between 2015-2019 and 2020-2024, but they increased in nearly twice as many counties — including some already near or above the $1,309 national median during the earlier period.

Rental costs increased and decreased in both large and small, urban and rural counties. Some areas, like Washington, D.C., had a cluster of nearby counties (Arlington and Fairfax in Virginia and Montgomery in Maryland) where median rents dropped from 2015-2019 to 2020-2024.

Did Lower Interest Rates Help Homeowners?

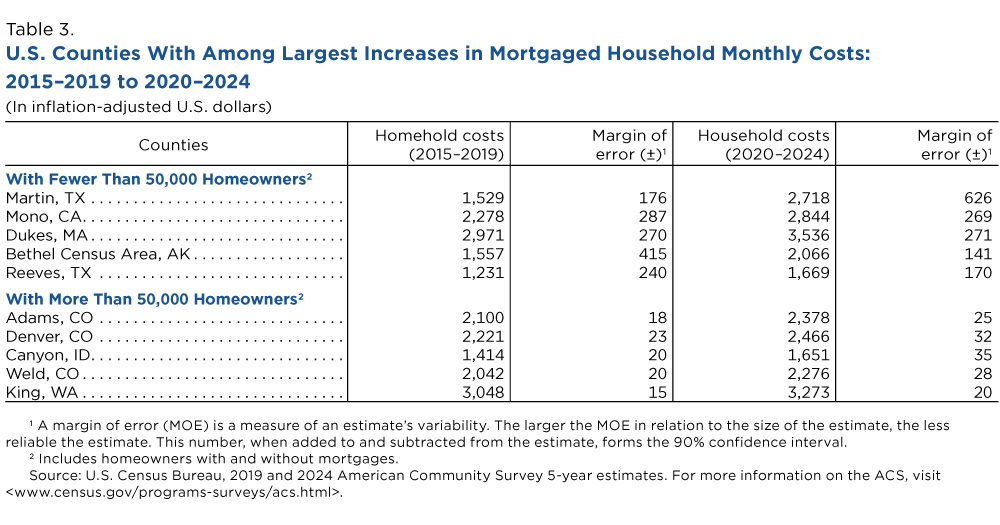

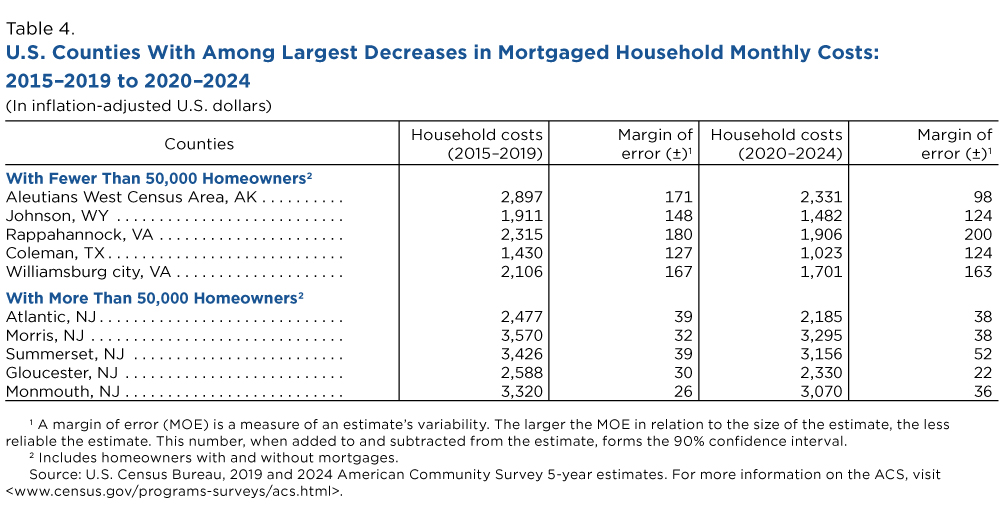

While mortgaged households’ median monthly costs (including mortgage payments, property taxes, utilities, insurance and condo, mobile home and other fees) remained unchanged at $1,963, these costs climbed in 369 counties but declined in 589 counties between the two five-year periods.

Three Colorado counties (Adams, Denver and Weld) had among the largest increases of counties with more than 50,000 homeowners. Martin County, Texas, in the Midland-Odessa metropolitan area, had some of the largest increases among smaller counties.

It should be noted that homeowners’ costs in the data do not include maintenance or repair fees which typically impact owners more than renters.

Some homeowners had lower costs despite rapidly increasing home values in most of the nation between the two periods.

The historically low interest rates during the COVID-19 pandemic may have helped drive down costs. Lower rates allowed homeowners to refinance and reduce their monthly payments, which was especially beneficial to those with high mortgages in areas with hefty home price tags.

All the counties (with over 50,000 homeowners) that had among the largest drops in homeowner costs were in New Jersey (Table 4). Several more counties (such as Mercer, Passaic and Bergen) in New Jersey were also among those with the largest drops.

Other states, including New York and Maryland, also had several large counties with among the largest decrease in mortgage homeowner costs. Many of these areas across the states had higher home values and costs than the rest of the nation in the 2015-2019 period.

They also had less dramatic increases in home values than the $65,000 hike in national median home values between the two five-year periods ($267,700 to $332,700). Homeowners in areas with already high home values would likely have the most to gain from lower interest rates.

About the Data

The ACS 5-year release includes data on a broad range of geographies and topics and is one of the best sources of information on areas that are not included in the ACS 1-year release because of a smaller sample size.

The ACS includes data on many housing topics like structure and occupancy, home amenities (kitchens, bathrooms and access to vehicles), housing costs and financing details.

Related Statistics

Subscribe

Our email newsletter is sent out on the day we publish a story. Get an alert directly in your inbox to read, share and blog about our newest stories.

Contact our Public Information Office for media inquiries or interviews.

-

HousingShare of Owner-Occupied, Mortgage-Free Homes Up in 2024January 29, 2026The share of U.S. homeowners without a mortgage was higher in 2024 than a decade earlier nationwide and in every state, though not all counties saw increases.

-

IncomeHow Income Varies by Race and GeographyJanuary 29, 2026Median income of non-Hispanic White households declined in five states over the past 15 years: Alaska, Connecticut, Louisiana, Nevada, and New Mexico.

-

HousingRecent Homebuyers Face Highest Mortgage Payments in Nearly Two DecadesSeptember 11, 2025Despite higher median monthly mortgage payments, homeowners who moved in 2024 lived in homes with lower median values than those who moved in 2021.

-

Income and PovertyMany U.S. Counties Had High Poverty Rates Over 20 YearsFebruary 26, 2026Recently released 2024 American Community Survey 5-year data identify places where poverty rates were consistently high since 2005.

-

EmploymentUnexpected Workforce Trends in Post-Pandemic ManhattanFebruary 19, 2026Recent jobs data show Manhattan’s workforce shares have shifted younger, more female and into the Accommodation and Food Services industries after the pandemic.

-

Business and EconomyAbility to Borrow Money Offers Clues to Financial Health of BusinessesFebruary 10, 2026Most employer businesses that applied for credit got what they asked for, according to the latest available data from the Annual Business Survey.

-

HousingShare of Owner-Occupied, Mortgage-Free Homes Up in 2024January 29, 2026The share of U.S. homeowners without a mortgage was higher in 2024 than a decade earlier nationwide and in every state, though not all counties saw increases.