Economic Census Highlights Industries That Notably Changed Between 2017 and 2022

The move away from brick-and-mortar retail stores toward online shopping deepened with pandemic-era demand for delivery and other changes in customer behavior altering the nation’s restaurant and hospitality sectors.

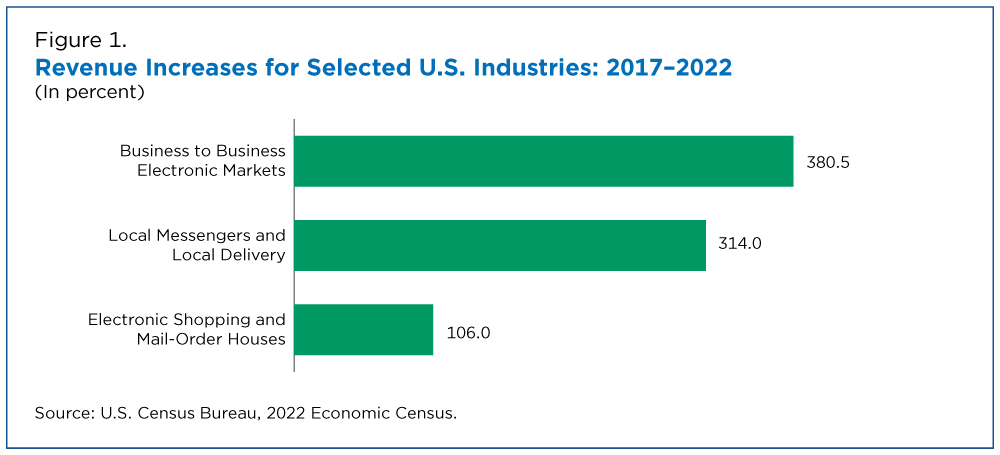

Industries supporting consumer convenience and digital transformation experienced some of the biggest spikes between 2017 and 2022.

Large shifts in industry revenue and employment occurred across the economy between 2017 and 2022, according to Economic Census comparative statistics, which provide a snapshot of how U.S. industries have changed over time.

The latest data are presented using 2017 North American Industry Classification System codes and cover a wide range of metrics. They are not adjusted for price changes.

Growth Fueled by Convenience-Driven Services and Digital Demand

Industries supporting consumer convenience and digital transformation experienced some of the biggest spikes between 2017 and 2022. The COVID-19 pandemic boosted online shopping, and the convenience became ingrained.

The Electronic Shopping and Mail-Order Houses industry, for example, grew by $546.7 billion, a 106.0% increase (Figure 1). Employment in this industry, which includes establishments selling merchandise using “nonstore” means like web retailers, grew by more than 1.2 million workers, a 215.3% gain.

Revenue in Business-to-Business Electronic Markets, which for a fee connects buyers and sellers of online goods, also posted a remarkable gain of 380.5% over the five-year period, a $11.8 billion jump in revenue.

The demand for fast and contactless service from workers who deliver groceries, meals, alcohol and other small parcels within a single metro area drove revenue in the Local Messengers and Local Delivery industry. The industry’s revenue soared 314.0% ($17.9 billion), while employment rose 214.8% (approximately 100,000 workers).

These trends further highlight the change in consumer purchases of food and other goods.

Traditional Retail and In-Person Services Declined

Industries relying on in-person interaction with physical products and customers faced steep declines, intensified by the pandemic and shifting consumer habits.

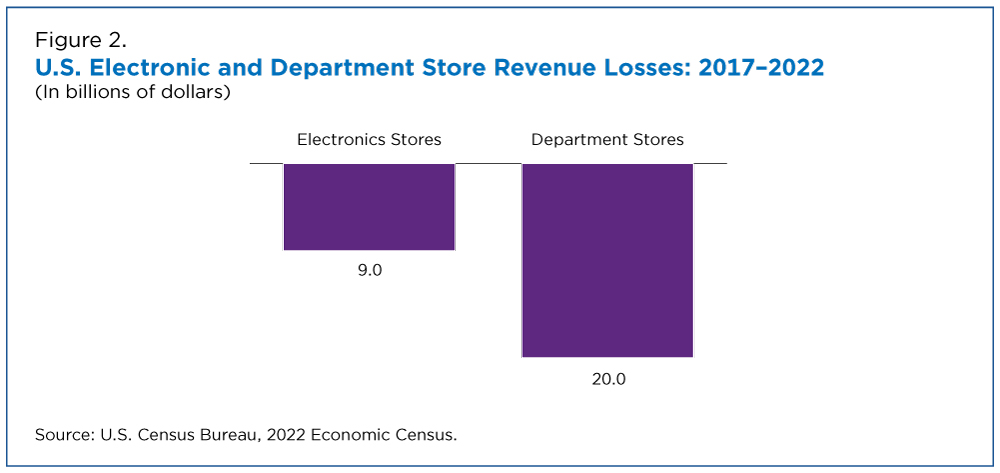

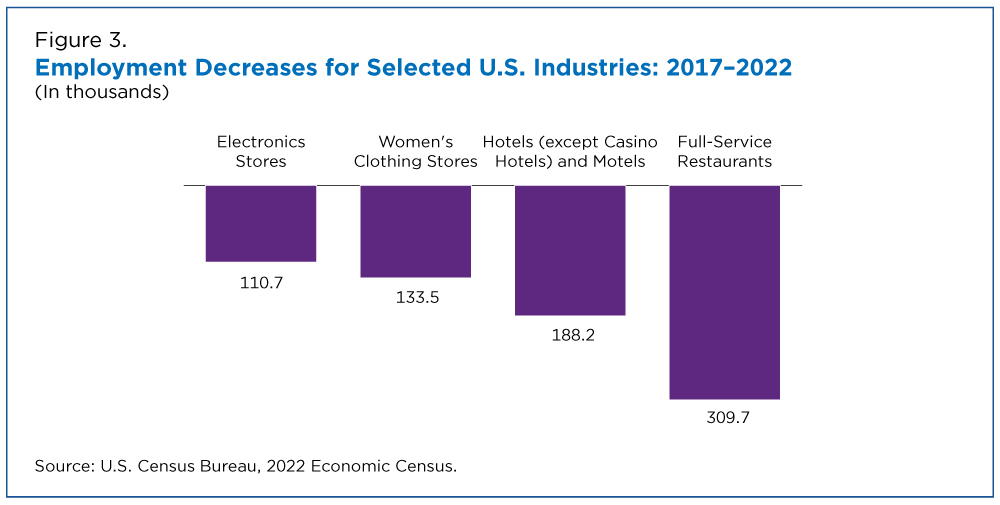

Electronics Stores were among the hardest hit: a $9.0 billion or 12.0% drop in revenue and loss of over 110,000 workers, a 40.8% decrease in its workforce (Figures 2 and 3). Department Stores saw revenue fall by even more — $20.0 billion or 30.1%.

Women’s Clothing Stores shed 133,535 employees (38.7%) and Children’s and Infants’ Clothing Stores dropped 45,254 (58.6%) (Figure 3). This contrasts with the increase already noted with the Electronic Shopping and Mail-Order Houses industry.

The hospitality and food service industries were also affected. Hotels (except Casino Hotels) and Motels lost 188,200 workers (11.7%) as pandemic-related travel restrictions softened lodging demand. Meanwhile, Full-Service Restaurants lost nearly 310,000 workers (5.7%), reflecting an in-person dining decline.

For more information on Economic Census data, visit the Economic Census webpage.

Related Statistics

Subscribe

Our email newsletter is sent out on the day we publish a story. Get an alert directly in your inbox to read, share and blog about our newest stories.

Contact our Public Information Office for media inquiries or interviews.

-

Business and EconomyFewer Workers as Number of Retail Clothing Firms ShrinkJuly 08, 2025As retail stores closed, employees left for other industries or jumped to new retail jobs.

-

Business and EconomyExploring Two “First Look” Economic DatasetsJune 06, 2024Early data from the 2022 Economic Census and 2023 Annual Business Survey offer a glimpse of the number of employer businesses in the United States.

-

NAICS Sector 31-33 ManufacturingSome Less Populous States Have High Manufacturing Revenue Per CapitaSeptember 29, 2025Today is the start of a week of celebrations at the Census Bureau marking the 14th annual Manufacturing Day on October 3.

-

IncomeHow Income Varies by Race and GeographyJanuary 29, 2026Median income of non-Hispanic White households declined in five states over the past 15 years: Alaska, Connecticut, Louisiana, Nevada, and New Mexico.

-

HousingRental Costs Up, Mortgages Stayed FlatJanuary 29, 2026Newly Released American Community Survey compares 2020-2024 and 2015-2019 housing costs by county.

-

HousingShare of Owner-Occupied, Mortgage-Free Homes Up in 2024January 29, 2026The share of U.S. homeowners without a mortgage was higher in 2024 than a decade earlier nationwide and in every state, though not all counties saw increases.

-

PopulationU.S. Population Growth Slowest Since COVID-19 PandemicJanuary 27, 2026The decline in international migration was felt across the states, though its impact varied.