Firms in Production Sectors and Northern States Have Some of the Highest Shares of Older Workers

Workers ages 55 or older have been the fastest-growing age group in the labor force for more than two decades and made up 24% of the U.S. workforce in 2022, up from 10% in 1994.

But not every workplace reflects this aging workforce.

New U.S. Census Bureau research shows that firms in some industries and some states had a much greater concentration of older workers than others.

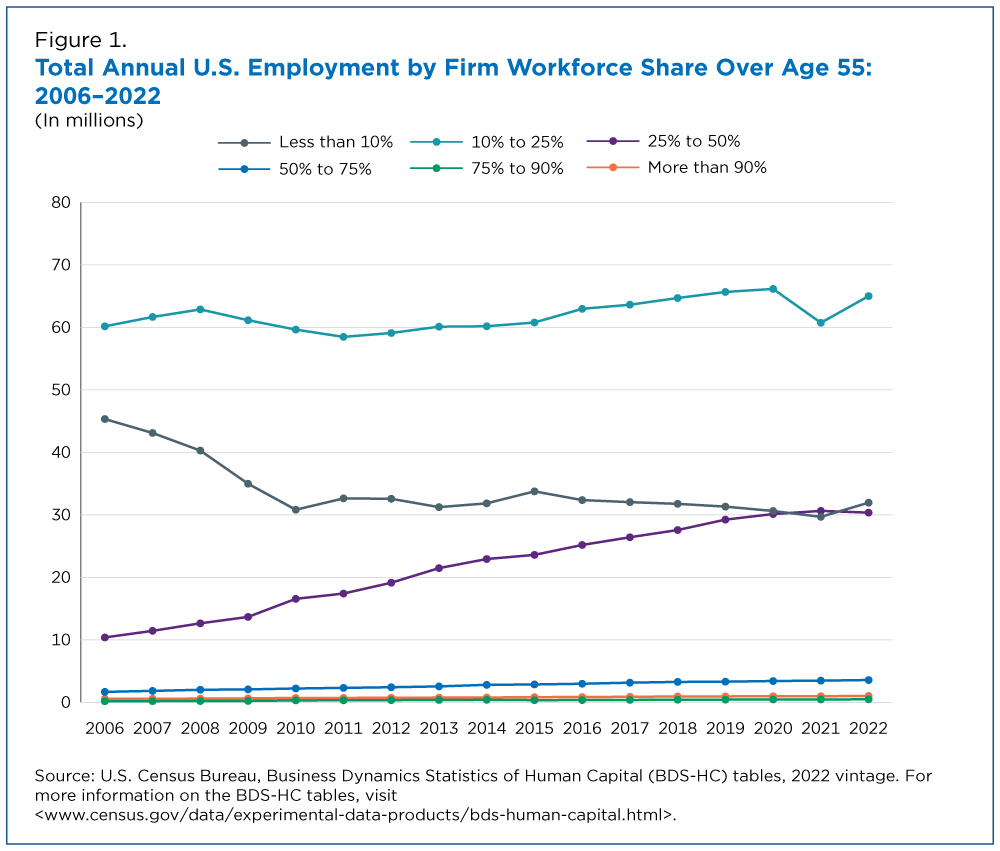

In 2006, 45 million workers were employed by firms with less than 10% older workers. But as the workforce aged, this number fell to around 32 million in 2022.

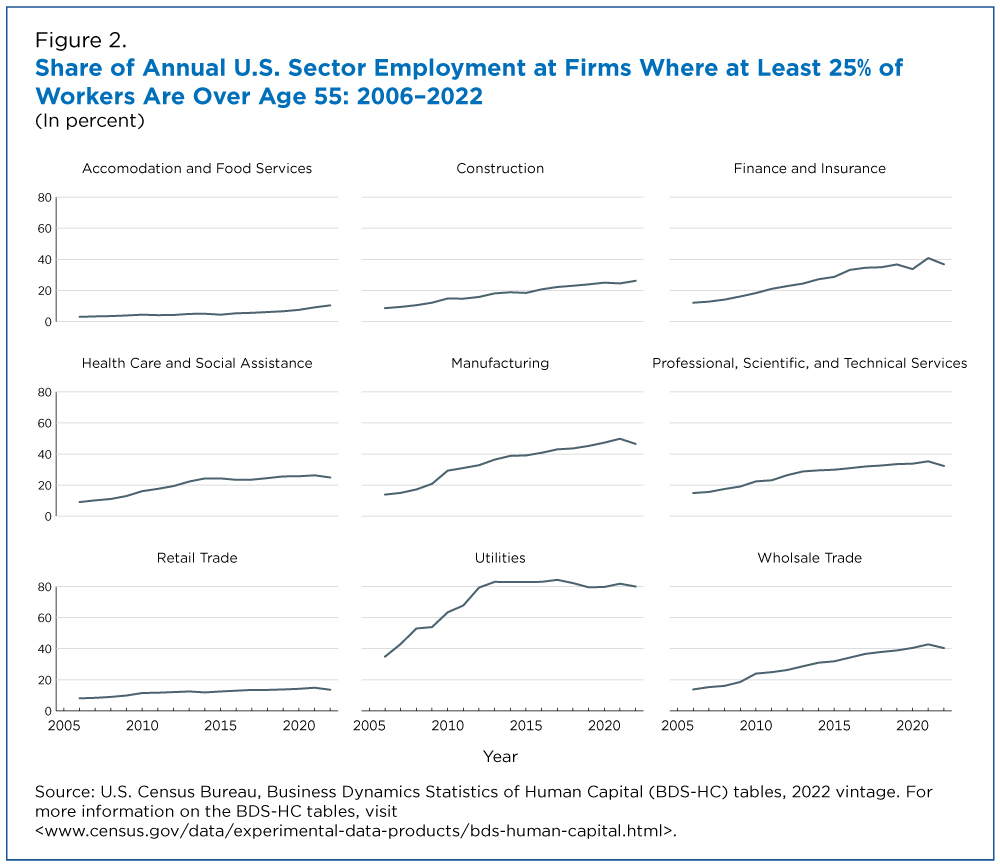

In the Utilities sector, for example, the share of employment at firms with at least a quarter of their workers over age 55 rose from 35% in 2006 to 80% in 2022. In contrast, only about 10% of total employment in the Accommodations and Food Services sector was at firms with at least a quarter of workers over age 55.

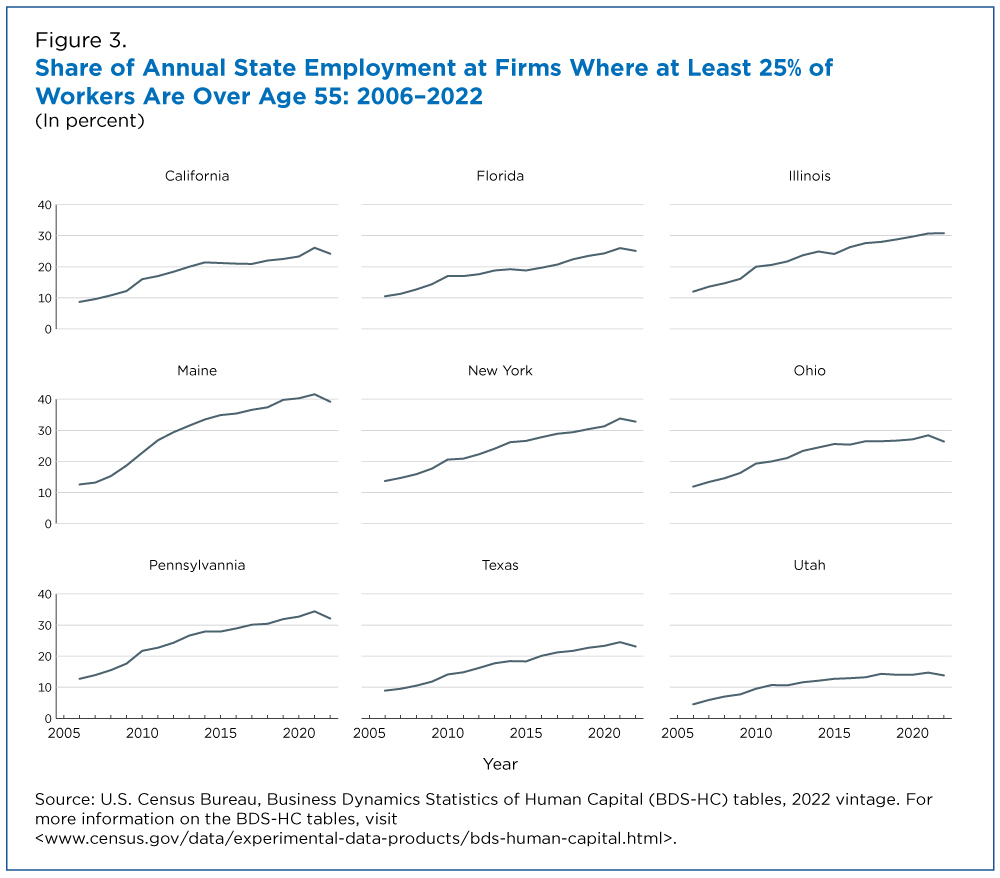

In Maine, 39% of all employment in 2022 was at firms where at least a quarter of workers are over age 55, the highest in the country. On the other hand, in Utah, only 14% of employment was at the same types of firms, the lowest in the country.

About the Research

The Census Bureau’s Business Dynamics Statistics of Human Capital (BDS-HC) tables classify firms based on their share of workers over age 55. By matching administrative tax records of workers to tax records of firms, we can calculate the share of a firm’s workforce that falls into this older age category.

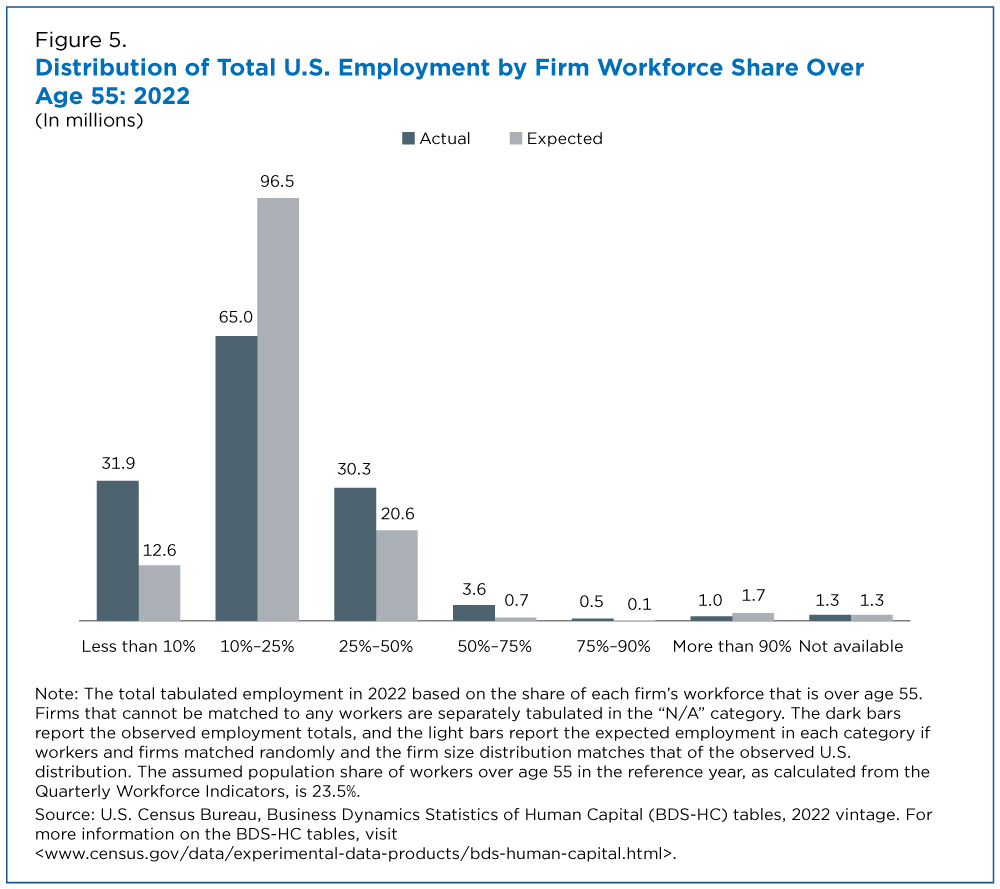

We sorted firms with similar shares of older workers into six groups: Firms with 10% or fewer older workers; 10% to 25%; 25% to 50%; 50% to 75%; 75% to 90%; more than 90%.

A 100-person firm in the “10% or fewer” group would have at most 10 workers over age 55. A 100-person firm in the “more than 90%” group would have at least 90 older workers.

Changes Over Past Two Decades

The distribution of older workers across firms has shifted over time.

In 2006, 45 million workers were employed by firms with less than 10% older workers. But as the workforce aged, this number fell to around 32 million in 2022.

At the same time, employment at firms with at least 25% of older workers rose from 13 million to 35 million.

The aging of firm workforces has been particularly rapid in a few sectors.

The Utilities sector experienced the most dramatic transformation in the past two decades. Eighty percent of all employment in that sector is now at firms with at least a quarter of their workers over age 55. In comparison, in 2006, only 35% of employment was at firms with similarly high shares of older workers.

Aside from Utilities, Manufacturing and Wholesale Trade also experienced substantial increases in the share of employment at firms with at least a quarter of their workers over age 55: from 14% in 2000 to over 40% in 2022.

On the other hand, the Retail Trade and Accommodation and Food Services sectors have traditionally had relatively few firms employing a high share of older workers.

Although these sectors also experienced increases in the prevalence of firms with at least a quarter of workers over age 55, these firms still only accounted for a small share of the overall employment in these sectors: 14% of all Retail Trade employment and 10% of all Accommodation and Food Services employment.

Aging States, Aging Workforce

The aging of firm workforces has been more pronounced in some states.

Some of these differences in firms reflect the differences in the population age distribution across states.

According to the Census Bureau’s most recent vintage population estimates, the median age of the population in Maine in 2022 was the highest in the nation at 44.7. Similarly, the BDS-HC tables show that 39% of employment in Maine was at firms with at least a quarter of their workers over age 55, the highest share in the country.

In contrast, only 14% of employment in Utah (the youngest state with a median population age of 32.0) was at firms with at least 25% of older workers, the lowest share in the country.

While Florida had many older residents (median age of 42.6 in 2022), only 25% of total employment was at firms with at least a quarter older workers.

Other states where the median age ranged from 39.1 to 40.9 in 2022, such as New York, Pennsylvania and Illinois had at least 30% of employment at firms with at least a quarter of older workers.

In younger states like California (2022 median age 37.8) and Texas (35.6), only about 25% of employment was at firms with such a high share of older workers in 2022.

However, the data also uncovers some patterns that would not have been apparent with person-level data alone.

While Florida had many older residents (median age of 42.6 in 2022), only 25% of total employment was at firms with at least a quarter older workers. While the population was older than New York, not as many people were employed by firms with high shares of older workers.

There are several potential explanations for this difference, including what industries are prominent in each state or what occupations are commonly held by workers. There may also be differences in how the labor market matches workers and firms in these states.

Growing Firms and Startups Have Younger Workforces

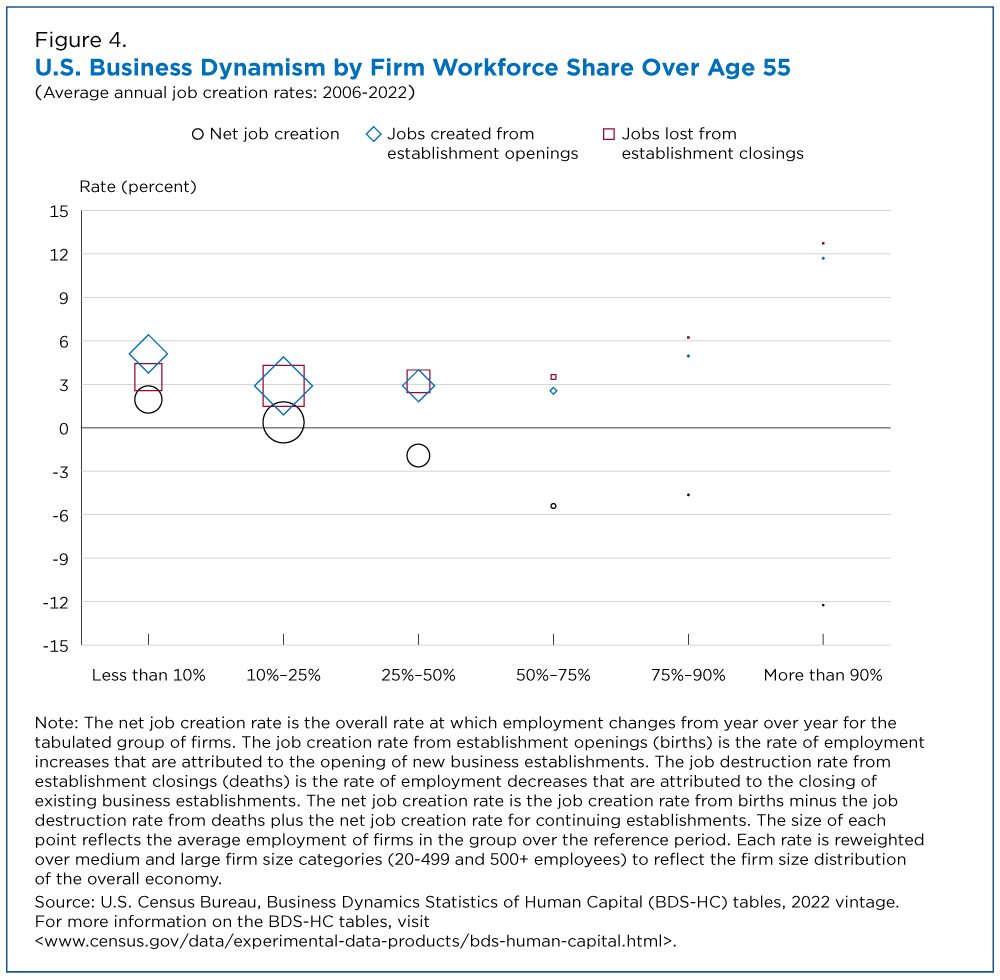

These differences in the workforce age composition at firms create real differences between the types of workers who are exposed to business growth as opposed to business decline.

After accounting for differences in firm size, we found that firms with a higher share of older workers tended to create fewer jobs and open fewer new business establishments. However, they are equally likely to close existing establishments relative to firms with a lower share of older workers.

On average, firms with 25%-50% of workers over age 55 shrank by around 2% per year, while firms with less than 10% of workers over age 55 grew by about 2% per year.

Startups showed the same patterns.

Small start-up firms were more likely to have higher shares of young employees than more mature firms in the same size group.

Ten percent of employment at newly opened firms was at businesses where more than half of the workers were ages 19 to 24. In contrast, only 3% of employment at firms that have operated at least 11 years was at firms where more than half of the workers fell in that young age group.

Start-up firms were also more likely to have a higher share of workers ages 25 to 34 and ages 35 to 44. More mature firms were substantially more likely to have a higher share of workers over age 55.

Seemingly Similar Firms May Have Very Different Workforces

Given that 24% of the overall U.S. workforce was age 55 or older in 2022, we would expect that firms would generally fall in the “10%-to-25%” share of the older workers category. But how much employment actually falls in this category depends on how firms select their workers and how workers choose their jobs.

We found that workers of similar ages tended to work together more often than random chance would predict.

Older workers may tend to work together for many reasons.

Some firms may have low turnover rates, resulting in their share of older workers growing as long-time employees age. It could also be caused by some firms requiring skills more commonly held by older workers. And it could be related to geography as some firms are in places where older workers make up a higher share of the population.

Statistical randomness also plays a role.

Employment at firms with mostly younger workers was 32 million, more than double the expected 13 million, while firms with 25%-50% of their workforces comprised of older workers had a total of 30 million employees instead of the expected 20 million.

Large firms hire many workers and, as a result, have a higher probability of ending up with a workforce that mirrors the overall U.S. workforce. Smaller firms hire fewer workers, and consequently, the characteristics of their workforces may be more varied.

To account for this randomness, we calculated the expected share of employment that falls in each age-share category based on random assignment of workers to firms of various sizes and compared it to actual employment in each category.

The results show how much employment would be in firms with different shares of older workers if statistical randomness and existing firm sizes were the only influencing factors. Differences between expected and actual amounts of employment in each category show that other factors also influence worker-firm matching.

Based on the economy-wide share of older workers, for example, we would expect that almost 97 million employees would work at firms with 10%-25% of older workers, but only 65 million did.

Employment at firms with mostly younger workers was 32 million, more than double the expected 13 million, while firms with 25%-50% of their workforces comprised of older workers had a total of 30 million employees instead of the expected 20 million.

Details on how we calculated these expectations are in The Composition of Firm Workforces from 2006–2022: Findings from the Business Dynamics Statistics of Human Capital Experimental Product.

This new research highlights the impact of demographic change on the nation’s firms and workers.

If these trends continue, the economic environments experienced by younger and older workers will continue to diverge. In addition, some firms may face challenges as a large share of their workers reach traditional retirement age. The BDS-HC tables help track these changes as the U.S. workforce continues to age.

Related Statistics

Subscribe

Our email newsletter is sent out on the day we publish a story. Get an alert directly in your inbox to read, share and blog about our newest stories.

Contact our Public Information Office for media inquiries or interviews.

-

EmploymentSocioeconomic Inequalities Between Remote Workers and CommutersJanuary 16, 2025Compared to commuters, home-based workers are older, more likely to be White and less likely to be in poverty.

-

EmploymentTrends in Self-Employment Among Hispanic WorkersJune 18, 2025Census Bureau data show that among younger and foreign-born workers, Hispanic workers are self-employed at higher rates than non-Hispanic workers.

-

EmploymentGenerational Wealth: How High Earners Help Their Children’s CareersAugust 12, 2025Young workers saw 24% greater earnings than peers when their first job was with a parent’s employer. Higher earners and blue-collar workers benefited most.

-

EmploymentUnexpected Workforce Trends in Post-Pandemic ManhattanFebruary 19, 2026Recent jobs data show Manhattan’s workforce shares have shifted younger, more female and into the Accommodation and Food Services industries after the pandemic.

-

Business and EconomyAbility to Borrow Money Offers Clues to Financial Health of BusinessesFebruary 10, 2026Most employer businesses that applied for credit got what they asked for, according to the latest available data from the Annual Business Survey.

-

HousingShare of Owner-Occupied, Mortgage-Free Homes Up in 2024January 29, 2026The share of U.S. homeowners without a mortgage was higher in 2024 than a decade earlier nationwide and in every state, though not all counties saw increases.

-

HousingRental Costs Up, Mortgages Stayed FlatJanuary 29, 2026Newly Released American Community Survey compares 2020-2024 and 2015-2019 housing costs by county.