Industry-level Detail Provides New Insights on the Growing Space Economy

The “space economy” continues to soar and younger workers are fueling the industry’s upward trajectory.

The extraterrestrial industry accounted for $142.5 billion (0.5%) of U.S. GDP in 2023, combining activities from the Manufacturing, Transportation, and Information sectors, including Satellite Telecommunications and Guided Missile and Space Vehicle Manufacturing.

In 2024, nearly one-half of all new hires in the Space Economy cluster were under the age of 35. This share, while down relative to the previous year, remained part of an upward trend in the hiring of young talent for the space workforce.

The U.S. Census Bureau released today the first ever Quarterly Workforce Indicators (QWI) at the national industry level. These data will allow users to view and download economic indicators such as employment, job creation, earnings and other measures of employment flows for six-digit North American Industry Classification System (NAICS) codes.

This level of detail opens new paths for analyzing parts of the economy that cross industry groups and provides unprecedented detail on the inner workings of our economy. The powerful new data enable us to boldly go where no one has gone before when examining this workforce of the future.

New Hires in the Space Economy Are Increasingly Younger

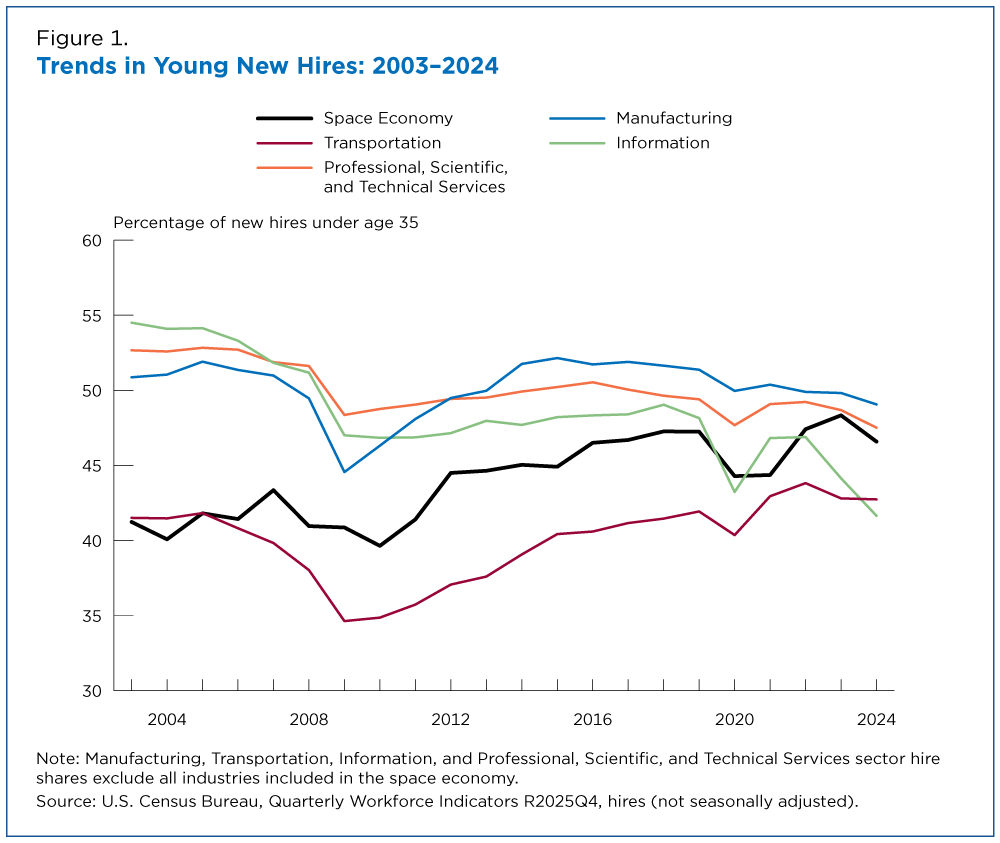

In 2024, nearly one-half of all new hires in the Space Economy cluster were under the age of 35. This share, while down relative to the previous year, remained part of an upward trend in the hiring of young talent for the space workforce (Figure 1).

The prevalence of these young workers is on par with that in the Professional, Scientific, and Technical Services sector, a distinct part of the economy employing similar workers.

Over the past decade, growth in the share of young new hires in the space economy (3%) far exceeded that of the nonspace components of the Manufacturing (-5%) and Information sectors (-13%). They are also consistently younger than new hires in the nonspace industries within the Transportation sector.

The growth among young workers in space fields also corresponded with an increase in worldwide commercial space activity in recent years. Revenue from private sector space activity in 2023 surpassed $445 billion, 5% higher than in 2022.

More Young Workers Are Employed in Most Areas of the Space Economy

The new detailed QWI data allow for industry-level tabulations, including for subgroups, a level of specificity not previously possible with this dataset.

Granular information on workforce indicators empowers policymakers and business leaders to more deeply understand the dynamics of highly specialized labor markets. For example, we now know that the share of workers under the age of 35 has increased over the last 10 years in five of the seven industries that make up the space economy.

At the same time, workers ages 35-54 are less prevalent in each of these industries but remain the largest segment of the workforce.

This decrease in the middle of the age distribution has not led to a corresponding increase in employment shares among the oldest workers (age 55 and over). Their employment share increased from 19% in 2014 to 25% in 2024 in the Satellite Telecommunications industry but decreased from 33% to 25% in the Guided Missile and Space Vehicle Manufacturing industry (Figure 2).

The net result across the space economy is a shift toward a younger workforce over the past decade — the share of workers under 35 increased 32% while the share over 55 increased by less than 1%.

In contrast to the patterns by age group, employment shares by sex have remained stable over the past decade, with men holding the overwhelming majority of these jobs (Figure 3).

As the space economy grows, observing employment dynamics by industry and demographics creates the opportunity to observe emerging trends in this specialized workforce that were previously difficult to measure.

One in Five Young New Hires Works in California, Arizona, or Florida

Space economy new hires under the age of 35 worked primarily in the West and South (Figure 4). In 2024, one-quarter of total U.S. space employment was in California, including 11% of all new hires under the age of 35 nationally.

The next most important states for young new hires were Florida (5% of new hires), Arizona (3%), Washington (3%) and Texas (3%).

As the space economy expanded over the past decade, the distribution of young new hires across states shifted. The share of new hires under the age of 35 working in California and Washington was slightly lower in 2024 (11% and 3%, respectively) compared to 2014 (13% and 5%).

Arizona, Florida and Utah all experienced increases of at least one percentage point in the share of national young new space hires working in their state over the same period.

About the Data

The tabulations in this story will soon be available through the QWI Explorer, which enables comprehensive access to the full depth and breadth of the QWI dataset. Through charts, maps and interactive tables, users can compare, rank and aggregate workforce indicators across time, geography and/or firm and worker characteristics.

While this story focused on the space economy, the new QWI data will be available for all parts of the economy.

Check out the What’s New announcement for more information about the expanded QWI industry tabulations or get answers to specific questions by emailing [email protected].

Related Statistics

Subscribe

Our email newsletter is sent out on the day we publish a story. Get an alert directly in your inbox to read, share and blog about our newest stories.

Contact our Public Information Office for media inquiries or interviews.

-

EmploymentU.S. Workforce is Aging, Especially in Some FirmsDecember 02, 2025Firms in sectors like utilities and manufacturing and states like Maine are more likely to have a high share of workers over age 55.

-

Business and EconomyRevenue and Employment Trends Reveal Shifts in U.S. EconomyDecember 30, 2025Revenue and employment losses in select retail industries continued, while online sales brokers and local delivery boomed.

-

EmploymentData Centers Growing Fast and Reshaping Local EconomiesJanuary 06, 2025Employment in data centers increased nationally in 2023 but over 40% was concentrated in five states.

-

Income and PovertyMany U.S. Counties Had High Poverty Rates Over 20 YearsFebruary 26, 2026Recently released 2024 American Community Survey 5-year data identify places where poverty rates were consistently high since 2005.

-

EmploymentUnexpected Workforce Trends in Post-Pandemic ManhattanFebruary 19, 2026Recent jobs data show Manhattan’s workforce shares have shifted younger, more female and into the Accommodation and Food Services industries after the pandemic.

-

Business and EconomyAbility to Borrow Money Offers Clues to Financial Health of BusinessesFebruary 10, 2026Most employer businesses that applied for credit got what they asked for, according to the latest available data from the Annual Business Survey.

-

HousingShare of Owner-Occupied, Mortgage-Free Homes Up in 2024January 29, 2026The share of U.S. homeowners without a mortgage was higher in 2024 than a decade earlier nationwide and in every state, though not all counties saw increases.